E-Invoicing in Estonia: A Complete 2025/2026 Guide

Estonia mandates B2G e-invoicing since 2019, with B2B gradually joining between 2025 to 2027. B2C e-invoicing is optional.

Last modified on 2025-12-18 in Blog

Estonia has established itself as one of Europe’s digital pioneers, and e-invoicing plays a major role in that success. The country that gave the world e-residency and digital government services is now applying the same tech-forward mindset to business transactions.

Estonia began its e-invoicing transition years ago by mandating electronic invoices for the public sector. Since 2019, B2G e-invoicing has been required through standardized formats such as UBL 2.1 and the Peppol network. Since 2025, Estonia mandates that you issue B2B e-invoices if your business partner requires it. A full B2B mandate is expected by 2027.

Estonia continues expanding its digital economy by enforcing new compliance deadlines. The 2025 mandate allows businesses to register as an e-invoice recipient, giving them the right to require e-invoices from their suppliers. By 2027, a fully mandatory B2B e-invoicing regime is expected to take effect, following the ViDA regulation, which mandates e-invoicing for intra-EU cross-border B2B transactions from July 1, 2030.

In Estonia, around 75 million invoices are exchanged each year, with approximately 45% already issued as e-invoices. Unlike paper invoices or scanned PDFs, e-invoices are machine-readable documents that can be automatically imported into an accounting or enterprise resource planning (ERP) system for processing. E-invoicing is the digital process of issuing, transmitting, and receiving e-invoices.

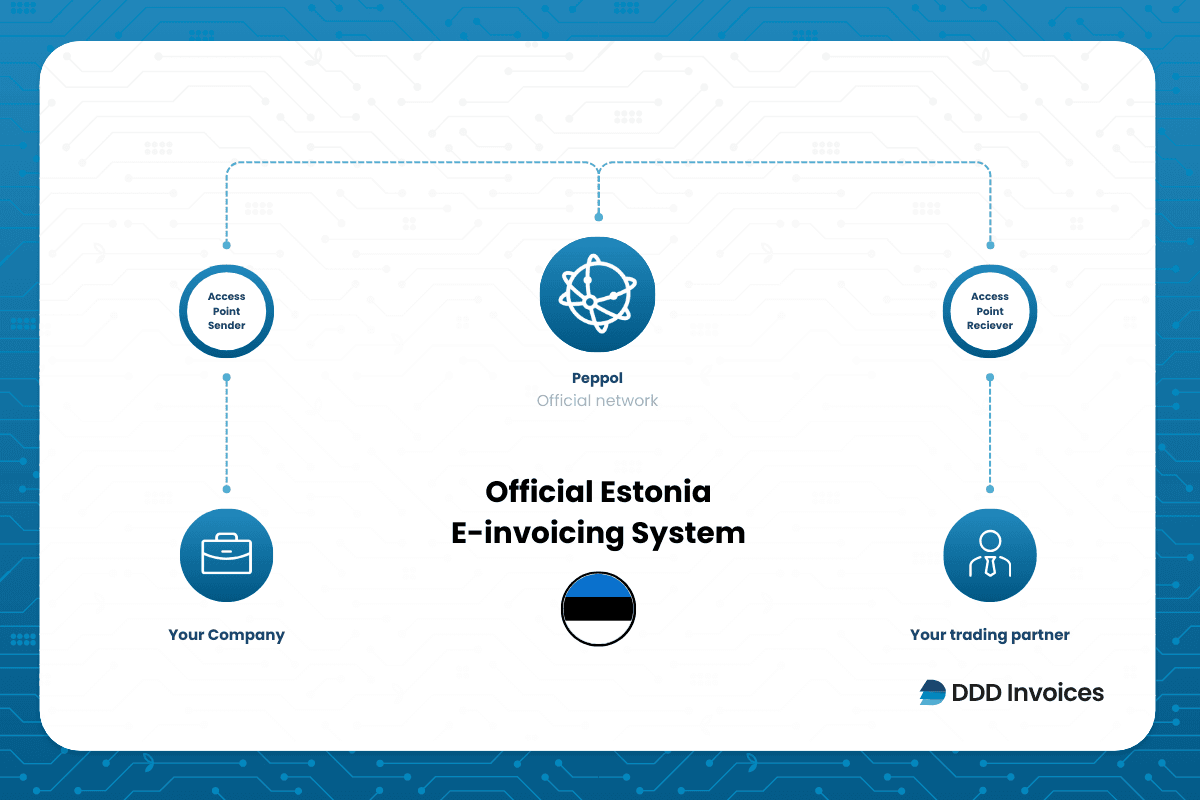

For Estonia, it means automated billing processes, eliminating manual errors, supporting tax compliance, and improving cash flow for both public and private sector suppliers. The e-invoices are sent via Peppol, UBL 2.1, or UN/CEFACT CII, which also enables seamless communication between accounting systems.

Estonia’s e-invoicing journey reflects its broader leadership in digital governance:

Estonia’s digital-first approach mirrors its global leadership in electronic governance. Its systems integrate Peppol and national standards like EVS 923:2014/AC:2017, ensuring EU interoperability and local compliance.

Since 2019, suppliers to Estonian government institutions must send structured e-invoices that meet the EN 16931 standard. E-invoices have to be submitted to platforms like Peppol or authorized service providers, using UBL 2.1 or UN/CEFACT CII formats. The system is overseen by the Ministry of Finance and the Tax and Customs Board.

From July 1, 2025, a buyer-choice invoicing model is implemented for B2B transactions in Estonia. Any company registered as an e-invoice receiver in the Estonian Business Register may require its suppliers to send invoices electronically in a structured format, notably the EU EN 16931 standard (such as UBL BIS 3.0 or UN/CEFACT CII).

E-invoicing for B2B transactions will become completely mandatory by 2027, requiring all businesses to transmit invoices electronically using EU-compliant formats.

Tired of scrolling through information about e-invoicing?

Currently, B2C e-invoicing and fiscalization are not mandatory in Estonia. Consumers and businesses can use traditional or electronic formats voluntarily. However, as the country expands its digital tax ecosystem, future integration of real-time e-receipts and consumer invoicing may follow the B2B rollout.

VAT returns must be submitted monthly to the Estonian Tax and Customs Board (MTA). The reporting deadline is the 20th of the next month. Returns are submitted electronically via the e-MTA portal, either by manual entry, file upload (XML/CSV), or via direct integration from accounting software.

VAT registration threshold is triggered when annual taxable turnover exceeds €40,000. After crossing the threshold, registration must occur within three business days. The threshold for reporting transactions, which used to be €1,000, will be eliminated, as all B2B transactions will automatically be declared, increasing transparency and closing VAT collection gaps.

Failure to comply with Estonian e-invoicing and VAT rules may lead to substantial penalties. VAT violations can result in fines of up to €32,000 with daily interest of 0.06%.

Here are a few examples:

For a deeper look into Estonian VAT and invoicing non-compliance penalties, click here.

Since 2019, Estonia has required all public entities to receive structured e‑invoices via Peppol or equivalent access points, following the EN 16931 standard. From July 1, 2025, a buyer‑choice model also allows registered companies to require electronic invoices for B2B transactions, ahead of full mandatory e‑invoicing for all businesses in 2027.

This system speeds up processes, reduces errors, and ensures compliance with legal archiving requirements.

We DDD Invoices connect directly to Estonia’s official e-invoicing platforms, handling invoice formatting, submission, and secure archiving with ease.

Whether you’re a software provider or a business, DDD Invoices simplifies compliance and lets you focus on business growth, without worrying about technical complexity or changing regulations.

Still have questions?

In the 30min free call we will discuss:

Businesses must use UBL 2.1 or UN/CEFACT CII, aligned with EN 16931 standards.

The Ministry of Finance and the Estonian Tax and Customs Board manage e-invoicing systems and compliance.

Invoices must be securely stored for seven years in compliant systems with encryption and access control.

Businesses save up to 50% in administrative costs, speed up payments, and reduce human error through automation. Automated workflows, faster payments, improved VAT compliance, reduced administrative costs, and digital security all make e-invoicing central to Estonia’s business operations.

As of 22.10.2025, B2B e-invoicing is mandatory or planned in the next 1-2 years in Italy, Hungary, Albania, Serbia, Romania, Poland, North Macedonia, Belgium, France, Spain, Latvia, Croatia, Slovakia, Slovenia, Montenegro and Germany.

The most common and high-potential niches for integrating e-invoicing as an additional growth engine include: Vertical SaaS, eCommerce, ERPs & CRM, Marketplace, POS & ticketing system, and payment processing.

Businesses typically monetize e-invoicing or use it to drive growth in one of the following ways:

For tailored strategies or alternative models, contact us and we’ll help you design a plan that fits your business goals and operational needs.

Written by the Compliance team

Reviewed by Denis V. P.