Latvia is getting ready to make e-invoicing mandatory, but the rules aren’t too strict yet. People are generally open to digital systems, and the process so far has been simpler compared to some other EU countries.

Latvia is getting ready to make a big change in the way businesses handle invoicing. From January 1, 2025, companies will be required to send electronic invoices for all B2G transactions. By 2028, e-invoicing will also become mandatory between B2B transactions. It’s a plan to cut down on paperwork, speed up payments, and bring more transparency to the tax system.

The Latvian government is also shifting towards compulsory e-invoicing to enhance transparency, minimize tax evasion. Starting January 1 2025, e-invoicing will be required for all B2G transactions in a structured format, with B2B e-invoicing set to follow in 2028. Companies will have to use the format as Peppol BIS 3.0 to remain compliant. Whether you are a small local firm or a big enterprise, these changes are going to change the way you manage your invoicing in Latvia.

Latest News

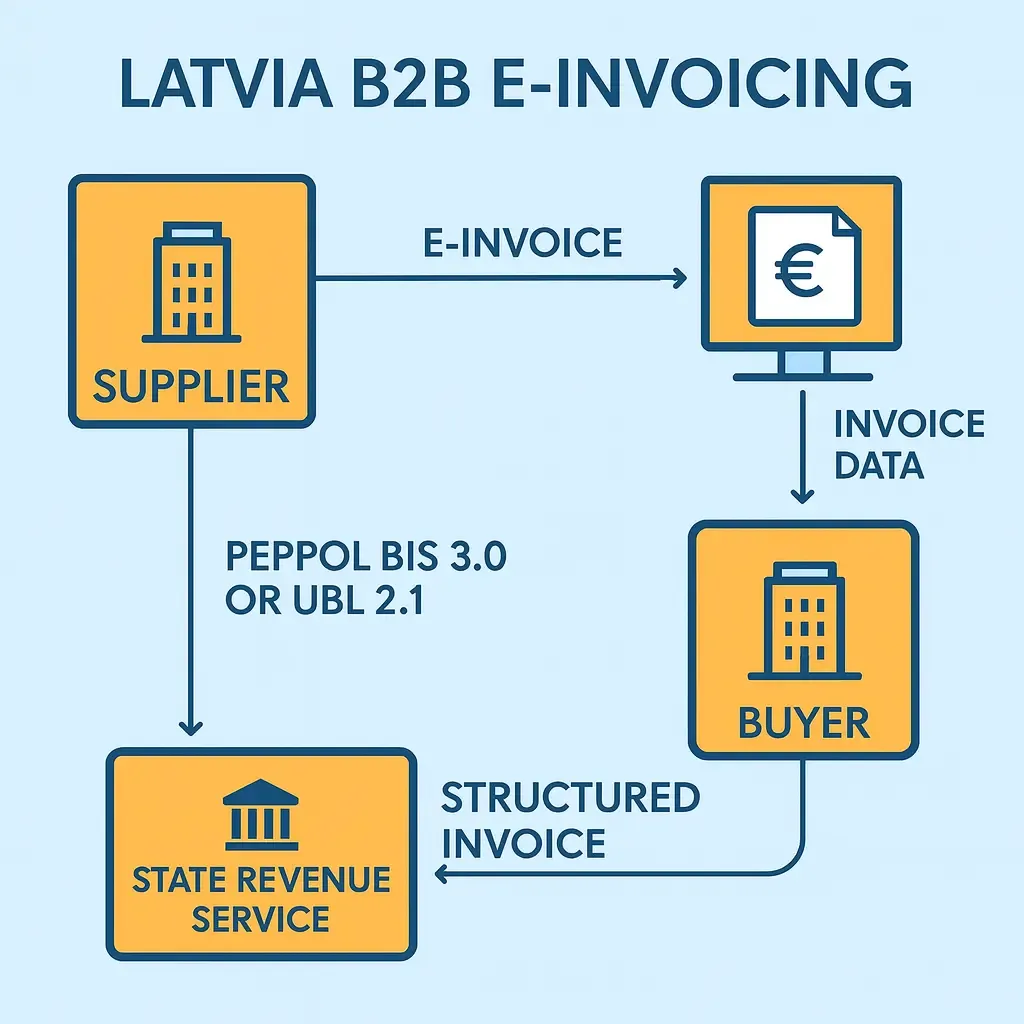

On October 31, 2024, the Latvian Parliament has approved amendments to the Accounting Law mandating structured B2G e-invoicing from January 1, 2025, following EU Directive 2014/55/EU. Invoices must be produced in machine-readable formats like UBL 2.1 or Peppol BIS 3.0 and submitted via platforms such as eAdrese.

Then, on June 5, 2025, the Latvian Parliament passed further amendments delaying the mandatory B2B e-invoicing deadline to January 1, 2028, while introducing structured invoice data reporting to the State Revenue Service (VID) for B2G and B2B transactions starting January 1, 2026. This phased rollout gives businesses additional time to upgrade systems and prepare before full implementation.

You do not need to know anything about e-invoicing standards or real-time reporting.

One single integration with our platform takes care of all of your current & future invoicing needs, everywhere.

Start free integrationWhat is e-invoicing and why is Latvia making it mandatory?

E-invoicing is the process of creating, sending, and receiving invoices in a structured digital format instead of on paper or PDF. In Latvia, this shift is part of a broader effort to modernize public administration, improve tax compliance, and align with EU Directive 2014/55/EU, which sets the European e-invoicing standard (EN 16931). With formats such as UBL 2.1 or Peppol BIS 3.0, invoices can be automatically processed between systems, and save time, minimize errors and maximize transparency.

In the case of Latvia, the implementation of e-invoicing is not only a matter of technology, it is to stop VAT fraud, overdone paperwork, and inefficiency of business. This is considered by the Ministry of Finance and the State Revenue Service (VID) a major measure to narrow down the estimated at approximately €193 million in 2022 around 5.0% of total VAT liabilities. The aim is to improve financial transparency and reporting through structured e-invoicing and data reporting systems.

Latvia has some certification rules for POS systems, but they’re not too complicated. Since the country is likely to follow other EU countries, getting ready early can help businesses stay ahead.

Why did Latvia delay the changes?

Latvia had originally planned to make B2B e-invoicing mandatory in 2026, but the government decided to delay it to January 1, 2028. Many small and medium-sized businesses said they needed more time to upgrade their systems and understand how to send invoices in the required formats like Peppol BIS 3.0 or UBL 2.1. The State Revenue Service (VID) also needed more time to build and test a reliable system to receive and process these invoices.

Several other European countries have already made the switch successfully. Italy, Belgium, and Serbia have all adopted e-invoicing, helping set the pace for digital transformation across the EU.

As DDD Invoices, we’ve supported many businesses through the transition making it easier for them to stay compliant, save time, and avoid manual errors. Latvia is now on the same path, just taking a more gradual approach to make sure every business can keep up.

Legislation timeline

B2G Timeline:

- April 2020 – All central government authorities in Latvia are required to receive and process electronic invoices in accordance with Directive 2014/55/EU.

- January 2023 – Use of the eAdrese platform becomes mandatory for all legal entities for secure communication with government bodies.

- January 1, 2025 – Mandatory e-invoicing begins for all B2G transactions. Suppliers to government entities must issue structured e-invoices in formats such as Peppol BIS 3.0 or UBL 2.1, compliant with EN 16931.

B2B Timeline:

- March 30, 2026 – Voluntary B2B e-invoicing begins. Businesses may start issuing e-invoices to other businesses using approved formats.

- January 1, 2028 – Mandatory B2B e-invoicing and structured data reporting to the State Revenue Service (VID) begins.

- All businesses registered in Latvia must issue and receive structured e-invoices for B2B transactions.

- E-invoices must follow Peppol BIS 3.0 or UBL 2.1 standards.

- Paper and PDF invoices will no longer be accepted for regulated transactions.

B2C Timeline:

- There is no legal requirement for businesses to issue e-invoices to consumers (B2C) in Latvia yet.

B2G (Business-to-Government) Transactions

Latvia has been compliant with EU Directive 2014/55/EU, which requires all public sector institutions in the EU to receive and process structured electronic invoices. Since April 2020, Latvian central government authorities have accepted e-invoices, and from January 1, 2025, it is mandatory for all suppliers to issue e-invoices when invoicing government institutions.

Latvia operates a decentralized model for e-invoicing. Public institutions may receive invoices via the eAdrese platform, which is maintained by the State Regional Development Agency (VRAA), or through certified Peppol service providers. All e-invoices must conform to the EN 16931 European standard using structured formats such as Peppol BIS 3.0 or UBL 2.1.

Enhanced Requirements:

- E-invoices must be in Peppol BIS 3.0 or UBL 2.1 format and comply with the EN 16931 European standard.

- Invoices can be sent through eAdrese or a certified e-invoicing operator connected to the Peppol network.

- All budget institutions are required to exchange structured e-invoices with suppliers and among each other.

Practical Considerations:

- Use of eAdrese is mandatory for all legal entities as of January 2023.

- Authentication for eAdrese is done via Smart-ID, eID, eParaksts.

- There are no invoice amount thresholds; e-invoicing applies regardless of contract value.

- Contracts signed before December 31, 2024, may delay the e-invoicing obligation until January 1, 2026, if agreed upon.

B2B (Business-to-Business) Transactions

Latvia is introducing mandatory B2B e-invoicing in phases through amendments to the Accounting Law. Originally planned for 2025, the mandatory B2B e-invoicing requirement has now been postponed to January 1, 2028, giving businesses more time to adapt.

Once in effect, all Latvian-registered businesses will be required to issue structured electronic invoices to other businesses, including to public institutions. E-invoice data will need to be submitted to the State Revenue Service (VID) using compliant structured formats such as Peppol BIS 3.0 or UBL 2.1, aligned with the EN 16931 European standard.

Enhanced Requirements:

All businesses in Latvia will have to issue e-invoices in a structured format. The invoices must follow European standards and be sent using Peppol BIS 3.0 or UBL 2.1, both aligned with EN 16931. Every invoice will also need to be submitted to the State Revenue Service (VID). These rules apply to all Latvian-registered companies, no matter their size.

Practical Considerations:

The new rules mainly cover domestic B2B transactions between companies in Latvia. Some cases, like payments through electronic cash registers or systems such as the National Health Service, will be exempt. Businesses have until January 1, 2028 to fully prepare for structured e-invoicing. Service providers like DDD Invoices can support companies in adapting early through the Peppol network and ensuring compliance.

B2C (Business-to-Consumer) Transactions

As of now, Latvia does not have a mandate for B2C (Business-to-Consumer) e-invoicing. This means businesses in Latvia are not legally required to issue structured electronic invoices when selling goods or services directly to consumers.

However, companies may still adopt e-invoicing voluntarily for B2C transactions to streamline their billing process, improve record-keeping, and provide customers with faster, digital payment experiences.

Enhanced Requirements:

- No legal obligation exists for structured B2C e-invoicing in Latvia.

- Traditional formats like paper or PDF invoices remain acceptable for B2C dealings.

- Businesses can adopt e-invoicing voluntarily using formats like UBL 2.1 if integrated into their systems.

Practical Considerations:

- B2C e-invoicing may offer benefits like faster payments, automated reconciliation, and customer convenience.

- Since B2C is not regulated under the same framework, companies have flexibility in choosing invoice formats and transmission channels.

Fiscalization

In Latvia, fiscalization plays a key role in ensuring tax compliance for retail and consumer-facing businesses. Certified fiscal devices such as cash registers and POS systems must be used to issue receipts that meet all legal requirements, including clear transaction details like date, time, item breakdown, VAT, and seller identification.

These devices must be officially approved by the State Revenue Service (VID) and installed by certified service providers. Each device is required to securely record every transaction, store the data in a tamper-proof format, and produce daily summary reports (Z-reports) to confirm compliance.

Latvian fiscal systems are not connected in real-time to the tax authority like in some other EU countries, but they are designed to ensure accuracy in VAT calculation, support audit readiness, and help prevent fraud. The use of certified fiscal devices is mandatory for most retail businesses.

Non-Compliance penalties in Latvia

As of January 1, 2028, failure to adhere to the Latvian e-invoicing requirements in B2B relationships may lead to severe fines in case your company does not comply with the rule. Failure to send a structured e-invoice in Peppol BIS 3.0 or UBL 2.1 format or failure to report the data of the invoice to the State Revenue Service (VID) may lead to the imposition of a fine up to € 2,000 per offense.

In case you miss out on issuing invoices that do not comply with the provisions of VAT, you may be punishable through fines (maximum amount fixed at 30% due on the VAT which was not paid) and interest charges which are charged 0.05% rates per day on delayed payments. The fines are on a per violation basis, an incorrect or late invoice would institute a fine.

In order to prevent these risks ensure that your business will be ready by the year 2028. To stay out of trouble and stay on track, make sure to use the appropriate format, encourage sending invoices using the approved channels such as eAdrese, and keep the records properly maintained.

How it connects to European Union rules

Latvia’s move toward e-invoicing is closely tied to European Union regulations, particularly Directive 2014/55/EU, which requires public authorities in all member states to accept structured electronic invoices. Latvia has adopted this through the national standard LVS EN 16931‑1:2017, ensuring that e-invoicing practices are following EU rules.

Starting January 1, 2025, all B2B transactions must follow this format, using platforms like eAdrese or approved access points that support structured formats such as Peppol BIS 3.0 or UBL 2.1. These changes aim to make transactions smoother and more transparent, both locally and when doing business with other EU countries.

Your trusted partner for E-Invoicing in Latvia

E-invoicing in Latvia is becoming the new standard, but keeping up with changing rules and formats can be complex. At DDD Invoices, we make it simple. Our platform connects directly with Latvia’s e-invoicing system and ensures your invoices are sent, received, and stored in line with both local and EU regulations.

You’ll save time, avoid errors, and stay fully compliant. Whether you’re just getting started or looking to upgrade your current setup, we’re here to help you every step of the way.

Let DDD Invoices handle the technical side, so you can focus on growing your business.

Still have questions?

Talk to us!

In the 30min free call we will discuss:

- your requirements in invoicing

- how integration works

- demo of the product

- next steps

Book a free 30min call

FAQs

When will it be compulsory to have e-invoicing in Latvia?

Beginning January 1, 2025, every business should issue an electronic invoice on a B2G basis. That would be any invoice to a public sector body. The B2B mandate has been delayed and will now start on January 1, 2028, to allow businesses additional time to get ready.

In Latvia, what is the e-invoice format required?

Latvia accepts the European standard of e-invoicing EN 16931, and invoices should be in such format as Peppol BIS 3.0 or UBL 2.1. These forms are organised and computer-readable, which facilitates the processing of invoices done in Latvia and other EU members.

What is the punishment on failure to comply with the e-invoicing rules?

Yes. The consequences of not sending e-invoices that are compliant and can be rejected with a fine up to € 2000 per invoice, VAT penalties or have your invoices rejected by the public sectors. To these issues DDD Invoices making sure that your invoicing activity is completely follow with the Latvian and EU needs.