What is an electronic invoice (e-invoice)

An e-invoice, or electronic invoice, replaces a paper invoice. It is used to send and receive transaction data electronically between a supplier and a buyer.

Last modified on 2026-01-06 in e-invoicing

Rather than relying on traditional paper-based processes, businesses use digital formats and technology to create, send, and manage invoices electronically. This approach offers various advantages over conventional invoicing methods, including increased efficiency, cost savings, improved accuracy, and enhanced transparency.

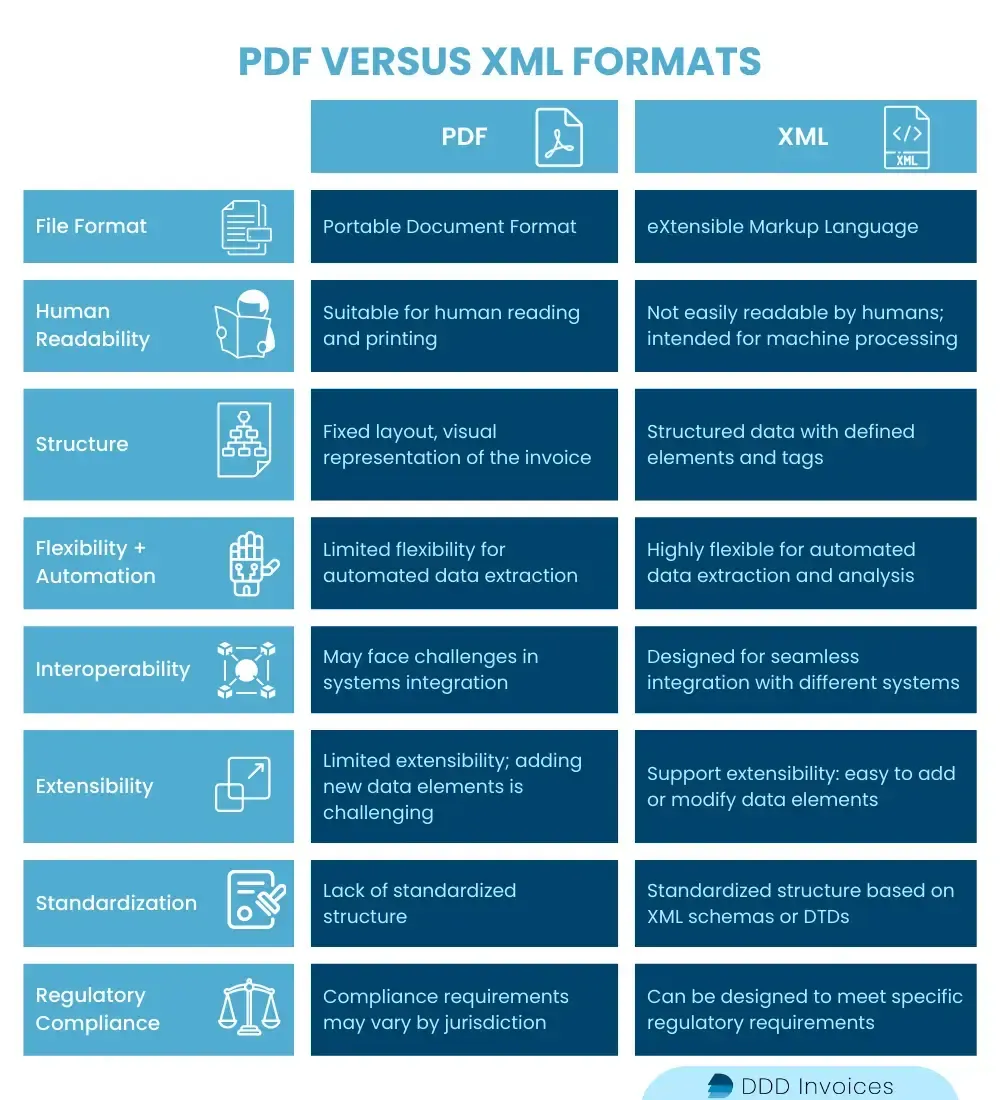

An electronic invoice is an invoice that is generated, transmitted, and received in a structured, machine-readable electronic format, typically using specific data exchange protocols such as XML or Electronic Data Interchange (EDI).

A digital invoice is not an electronic invoice. It is sent and received digitally in a PDF or JPG format instead of an unstructured invoice.

A paper invoice is a physical, printed document that contains all the necessary information for billing and payment, but is inefficient due to higher costs and manual processing.

An e-invoice is a structured digital document that contains all of the relevant information about a commercial transaction between a buyer and seller. Since the data is structured, it is much easier for a computer to understand it, allowing for the automation of this otherwise manual, time-consuming process.

Governments have embraced e-invoicing as a mean of combating tax evasion by providing a more efficient and safer way of exchanging invoicing data. Tax administrations around the world have introduced legislation to enforce electronic invoicing, with some even mandating it. The adoption around the world varies by country and industry. For example in the EU, Directive 2014/55/EU defines the regulatory framework.

Familiarize yourself with the specific e-invoicing standards applicable in your region or industry. This may include forms such as XML, UBL (Universal Business Language), EDIFACT (Electronic Data Interchange for Administration, Commerce, and Transport), or specific government-mandated standards.

Use e-invoicing software that supports the required standards, such as the DDD Invoices solution. Ensure that your software is capable of generating or processing invoices in the specified configuration and can handle the necessary data elements and validation rules.

If your existing invoicing software does not produce invoices in the required structure, you may need to map and transform your data to comply with the standards. This can involve mapping your data fields to the corresponding fields in the e-invoicing format and converting the data structure accordingly.

Establish connections with your trading partners, customers, and suppliers to exchange e-invoices in a standardized layout. This may involve configuring your systems to transmit invoices via Electronic Data Interchange (EDI), web services, or other agreed-upon methods.

E-invoicing benchmarks and regulations can evolve over time. Stay informed about any updates or changes to the standards in your region or industry. This ensures ongoing compliance and helps you adapt your systems and processes accordingly.

Tired of scrolling through information about e-invoicing?

The storage period for electronic invoices varies from country to country and depends on the specific regulations of each tax authority. For B2B transactions, companies are required to keep invoices for a certain period of time, typically ranging from six to ten years. Additionally, some countries require that invoices must be archived within their borders, while others allow for storage abroad. It is important to check with the relevant authorities to ensure that all electronic invoices are being stored correctly and for the required length of time to avoid any penalties or fines.

On the flip side, there are many real benefits to e-invoicing. Using the proper e-invoice format through the implementation of an efficient system and other business systems will make sending receipt information from a supplier to a buyer faster than ever before.

E-invoicing produces significant business expense savings achieved by removing paper and instead having invoices received and processed electronically, such as postage and printing costs. They help reduce costs associated with archiving, retrieval, and manual invoicing, leading to improved efficiency and reduced administrative overhead.

Automation of invoicing streamlines the entire invoicing procedure, allowing invoices to be created, delivered, and processed quickly. This results in faster approvals, shorter payment cycles, and improved cash flow for both suppliers and buyers. Auto-generated reminders and notifications can also be set up to ensure fast payment times and minimize delays.

Electronic invoicing in a structured format reduces the likelihood of errors and data entry mistakes that are common in its manual paper predecessor. The use of structured data configurations and automated validation helps ensure accurate information is captured, reducing the risk of disputes and reconciliation issues.

Businesses gain better visibility into their invoicing and payment processes. Real-time tracking and monitoring of invoice status provide insights into the progress of transactions, enabling proactive management and issue resolution. Auditing becomes more straightforward as all relevant data is stored electronically and can be accessed for compliance or analysis purposes.

An electronic invoice is an invoice that is created, sent, and received electronically. It is a digital version of a paper invoice and typically has the same information. This includes data such as the supplier's name and address, the customer's name and address, and the details of the products or services being sold.

To send and receive them, both the supplier and customer must have an e-invoicing solution in place. This can involve using software, setting up an electronic invoicing system, or using another method to automate the typically manual procedure.

An EDI enables the efficient and secure transmission of invoice data between trading partners in a standardized electronic format. It acts as a communication protocol that allows businesses to transmit structured invoice data directly from one system to another, eliminating the need for manual data entry.

Written by the Compliance & Growth Team

Reviewed by Denis V. P.