All About B2B E-Invoicing in Serbia (in 2025)

B2G and B2B e-invoicing are fully mandatory in Serbia via the SEF platform, B2C e-invoicing is expanding, with fiscalization required for all retail sales since May 2022

.webp&w=750&q=75)

.webp&w=750&q=75)

UBL 2.1

SEF

Ministartstvo Finansija

Central Platform Exchange

1 May 2022

1 Jan 2023

10 years

The introduction of mandatory B2B e-invoicing in Serbia, as required by the Law of Electronic Invoicing (RS 44/2021, 129/2021), has marked a significant turning point for businesses of all sizes, from small shops to large corporations. Since January 2023, the Serbian government has required every company regardless of industry or scale to transition from traditional paper and PDF invoices to a fully digital system managed through the official SEF (Sistem e-Faktura) platform. The new system brings both challenges and opportunities, compelling companies to rethink their invoicing processes and adopt new technologies to remain compliant and competitive.

Serbia’s B2B e-invoicing framework is built around the SEF platform, which serves as the central hub for creating, sending, and receiving all business invoices in a standardized UBL 2.1 XML format. To access SEF, companies must register through eID.gov.rs and use secure authentication methods such as two-factor authentication or a qualified electronic certificate, ensuring that only authorized personnel can handle sensitive financial data.

By enforcing these standards and leveraging the technical infrastructure, Serbia’s e-invoicing system not only ensures compliance but also sets the stage for greater efficiency, security, and future cross-border digital transactions.

As of mid-2025, Serbia requires all businesses, including those involved in B2B, B2G, and certain B2C transactions, to issue and receive invoices exclusively through the government’s Sistem e-Faktura (SEF) platform in the UBL 2.1 XML format, as mandated by the Law on Electronic Invoicing managed by the Ministry of Finance.

While B2B and B2G e-invoicing have been fully mandatory since January 2023, the government has begun expanding e-invoicing obligations into specific B2C sectors, especially where consumer transactions are significant or tax compliance risks are high.

The SEF platform has seen technical upgrades to support this broader scope, and enforcement has intensified: non-compliance can result in fines from 50,000 to 2,000,000 RSD for companies and up to 1,270 EUR for directors.

Tired of scrolling through information about e-invoicing?

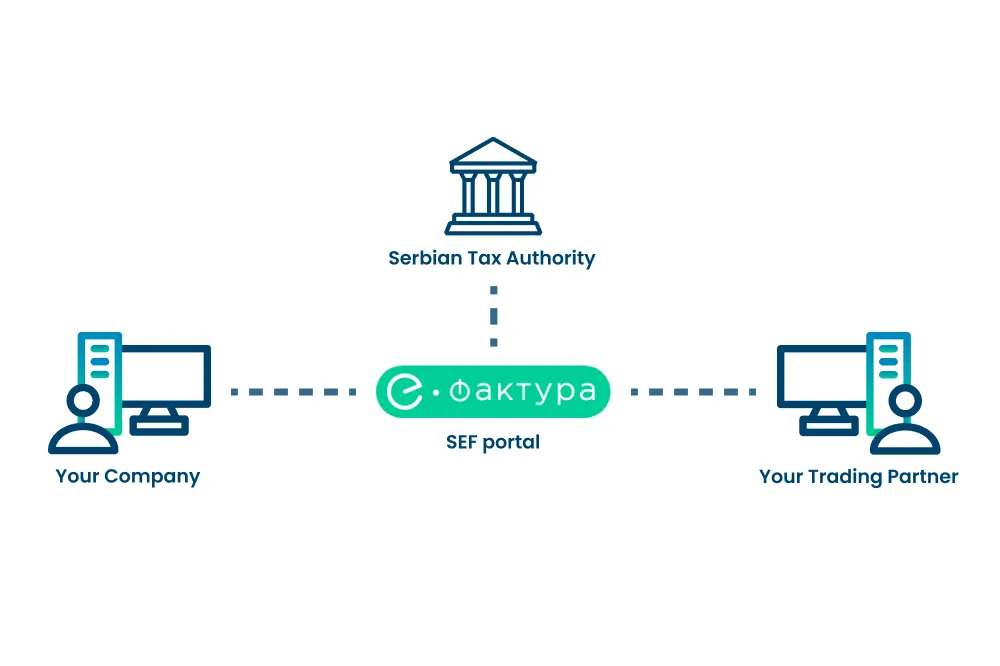

E-invoicing means that all businesses must send, receive, and store invoices online through the government’s Sistem e-Faktura (SEF) platform. The e-invoicing process via this platform takes place as shown below:

The goal is to make business faster, more transparent, and easier to track. It also helps reduce paperwork, mistakes, and tax fraud. Every invoice, whether sent to another business or to a government agency, must go through SEF. If a company does not follow this rule, it can face serious fines. Businesses can choose to enter invoices manually on the SEF platform or use automated tools that connect with their accounting software.

With years of experience in the Serbian market, we’ve observed that while many companies technically comply with e-invoicing regulations, inefficiencies persist. Due to the way the system is set up, businesses often send both electronic and paper invoices, undermining the benefits of digitalization.

To truly improve efficiency and financial control, companies need to move beyond basic compliance and fully embrace electronic invoicing. This shift is essential for reducing administrative burdens and keeping pace with Serbia’s digital business environment.

In Serbia, B2G e-invoicing became mandatory on May 1, 2022. All suppliers to public authorities are required to submit their invoices exclusively through the SEF platform.

Key Features:

Mandatory Use: All public administration suppliers must send invoices electronically; authorities must be able to receive and store them digitally.

Standardized Format: Invoices must use the UBL 2.1 XML format.

Validation and Archiving: The SEF platform validates invoices before sending them to recipients, and all invoices must be archived for 10 years.

Penalties: Non-compliance can result in significant fines for both companies and their directors, ranging from 50,000 to 2,000,000 RSD for companies and up to 1,270 EUR for directors.

B2B E-invoicing is mandatory in Serbia for all transactions. Every transaction must be validated and archived by the Ministry of Finance, ensuring compliance and transparency.

Businesses can choose to enter invoices manually through SEF’s web app or opt for integrated solutions like DDD Invoices, which use API connectivity to automate compliance, minimize errors, and eliminate double data entry.

Centralized Platform: All B2B e-invoicing in Serbia is managed through the government’s Sistem e-Faktura (SEF) platform.

Mandatory Format: Invoices must be submitted in the UBL 2.1 XML format, which is required for compliance.

Government Validation: Every transaction is validated and archived by the Ministry of Finance, ensuring regulatory compliance and transparency.

Submission Methods:

1.Businesses can manually enter invoices using the SEF web application.

2. Alternatively, companies can use integrated solutions that connect via API to automate the invoicing process.

Benefits of Integration: API-based solutions help automate compliance, reduce errors, and eliminate the need for double data entry.

SaaS providers and software developers can benefit from our invoicing, e-invoicing, and fiscalization API, designed for seamless compliance and integration.

As of mid-2025, B2C (business-to-consumer) e-invoicing is not yet universally mandatory in Serbia in the same way as B2B and B2G e-invoicing while fiscalization in Serbia plays a crucial role alongside e-invoicing by enabling real-time transaction reporting to tax authorities, which strengthens tax compliance and reduces fraud.

The government has, however, signaled its intention to gradually expand e-invoicing obligations to certain B2C sectors, especially those with high transaction volumes or higher risks for tax evasion.

Businesses should monitor updates from the Ministry of Finance and the SEF portal for future mandates.

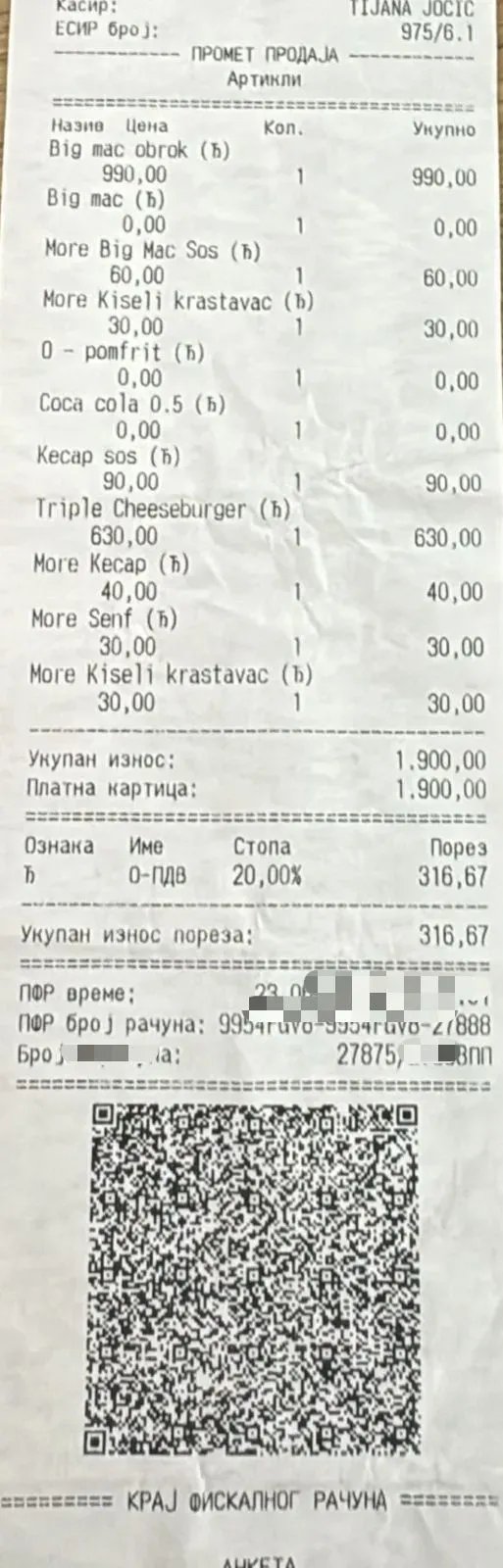

Fiscalization is the process by which retail transactions (B2C sales) are recorded and reported in real time to the Serbian Tax Administration. The current system, known as the “new model of fiscalization” (novi model fiskalizacije), has been mandatory since May 1, 2022. It applies to all businesses that sell goods or services to consumers (B2C), regardless of their size or sector.

All B2C transactions must be registered through an approved electronic fiscal device (fiscal cash register or POS system) that is connected online to the Tax Administration.

Each sale generates a fiscal receipt (fiskalni račun) with a unique QR code and transaction ID, which is sent in real time to the tax authorities.

The system is designed to prevent tax evasion, increase transparency, and ensure accurate VAT reporting for retail sales.

Businesses must use certified fiscal devices and software, and there are strict requirements for data security and retention.

Our POS invoicing and fiscalization API lets you integrate fiscalization directly into your POS system, however if you are an e-commerce provider explore our e-commerce e-invoicing and fiscalization API.

Serbia is advancing its digital tax system by planning to introduce electronic reporting of standardized tax and accounting data, known as e-reporting. A key part of this is the future adoption of the Standard Audit File for Tax (SAF-T), an international standard for submitting accounting data electronically to tax authorities.

As of 2025, SAF-T is not yet mandatory in Serbia but is expected to be introduced in the coming years.

Serbia’s Law on Electronic Delivery Notes was published on November 28, 2024, and took effect on December 6, 2024. The law requires both public and private entities to issue electronic delivery notes before transporting goods, and carriers must show these notes during inspections.

Starting January 1, 2026, public entities and some private entities must use e-delivery notes in certain transactions; from October 1, 2027, private entities must also use them for B2B and B2G goods movement. More detailed rules will be set within 90 days of the law’s start.

As Serbia moves toward fully digital invoicing, businesses now face both new opportunities and new responsibilities. To keep up, you need a solution that meets legal requirements, makes invoicing faster and more efficient.

At DDD Invoices, we know that every business is different, whether you work with the public sector, other businesses, or consumers. Our platform is built to support you through Serbia’s changing rules.

We’re directly connected to the official Sistem e-Faktura (SEF) platform, so your e-invoices are created, sent, and stored exactly as the Law on Electronic Invoicing requires. That includes using the UBL 2.1 XML format and keeping your invoices safe for 10 years.

We give you a modern, flexible solution that grows with your business. We make compliance easy, speed up your workflow, and help you get the most out of e-invoicing. So your business stays efficient, competitive, and ready for what’s next.

Still have questions?

In the 30min free call we will discuss:

All businesses in Serbia must use the SEF platform to send and receive invoices for B2B and B2G transactions.

If you don’t follow the e-invoicing rules, such as not using the SEF platform, missing deadlines, or using the wrong invoice format, you can be fined between 50,000 and 2,000,000 RSD. Company directors can also be fined up to 1,270 EUR. However, if you correct mistakes in your VAT or tax records before an official inspection starts, you won’t be penalized.

No, e-invoicing is not fully required for B2C sales yet, but the government plans to expand it to some B2C sectors in the future.

The current “new model of fiscalization” has been mandatory since May 1, 2022, for all businesses selling goods or services to consumers in Serbia.

Written by the Compliance & Growth Team

Reviewed by Denis V. P.