E-Invoicing in Malta (2026 update)

E-invoicing in Malta is mainly encouraged within the public sector, where public entities have to be able to receive electronic invoices. For B2B and B2C transactions, e-invoicing remains optional.

Last modified on 2025-12-18 in Blog

Malta is slowly becoming one of the most business-friendly digital environments in the EU. Its early adoption of e-invoicing has created a competitive advantage that forward-looking companies are already leveraging. While other EU countries rush to meet mandatory deadlines, Maltese businesses have time to adopt systems gradually and refine processes before regulations tighten.

Malta currently enforces semi-mandatory regulations for B2G transactions, while e-invoicing for B2B and B2C transactions is still voluntary. Public authorities must be able to accept EN 16931-compliant invoices for contracts above EU thresholds, using formats such as Peppol BIS Billing 3.0 or UBL. Under the EU VAT in the Digital Age (ViDA) package, mandatory B2B e-invoicing rules are expected by 2030, and Malta is already preparing its systems to align with those standards.

Malta has adopted the European e-invoicing standard EN 16931, which ensures that electronic invoices are machine-readable, structured, and interoperable across different systems within the European Union. This standard enables consistent, accurate, and efficient processing of e-invoices between businesses and public entities.

As of the moment, e-invoicing in Malta is only semi-mandatory for B2G transactions, meaning public authorities must be able to receive and process e-invoices, but there is currently no fixed timeline for the mandatory implementation of B2B or B2C e-invoicing.

E-invoicing replaces traditional paper-based billing with structured digital documents, enabling automatic processing, creation, and issuing of invoices while reducing manual labor and errors. In Malta, e-invoicing enhances efficiency, as businesses create, send and report invoices faster, improves transparency, as companies can check invoices' compliance and legibility, makes tax reporting faster and enables compliance with EU standards.

The Malta Tax and Customs Administration (MTCA) oversees implementation, ensuring that invoices sent to public authorities comply with EN 16931 and use formats like Peppol BIS Billing 3.0 or UBL. As of the moment, a remarkable 71% of small and medium enterprises (SMEs) in Malta have at least a basic level of digital intensity, heavily leveraging cloud and big data tools, especially in tourism and retail.

Malta's e-invoicing journey reflects a methodical and well-planned approach to digital transformation:

Malta’s B2G e-invoicing is semi-mandatory. While suppliers are only encouraged, but not required to issue them e-invoices, public authorities must accept EN 16931-compliant e-invoices for contracts above EU thresholds.

Here are a few examples:

Although Malta lacks a central e-invoicing platform or real-time reporting, this open model allows businesses to connect via providers like DDD Invoices, ensuring compliance and smooth e-invoice creation, issuance and receiving.

Currently, B2B e-invoicing remains voluntary in Malta. Businesses can freely choose when and how to adopt electronic invoicing. They are encouraged to use Peppol BIS Billing 3.0 and EN 16931 standards to prepare for future regulations. The EU’s ViDA initiative is introducing new digital reporting obligations by 2030, so Malta is preparing a gradual transition toward mandatory B2B e-invoicing.

The General ViDA plan is to:

Tired of scrolling through information about e-invoicing?

Malta has no mandatory B2C e-invoicing or fiscalization requirements at present. Consumer invoices can still be issued in traditional formats, or in simplified format for transactions under €100. Yet as digital receipts and online accounting systems gain popularity, the government is studying potential frameworks for integrating B2C transactions into national e-reporting mechanisms aligned with EU digital tax reforms.

POS (Point of Sale) systems used for fiscal purposes in Malta must be certified to comply with VAT regulations. A practicing auditor verifies that both the hardware and software meet the standards set out in the VAT Act, including:

Once approved, the auditor issues an audit certificate, submitted to the Maltese VAT Department along with a technical certificate from the supplier. The Department then assigns an EXO (Exemption) number, unique to each retail outlet, which must appear on every fiscal receipt.

To create an electronic invoice in Malta, companies should use formats like Peppol BIS Billing 3.0 or UBL XML, compatible with EN 16931 standards. The e-invoices can then be issued based on businesses’ preferences. Here are the 2 most common methods based on the company's volume and technical capabilities:

Option 1: Manually through an E-invoicing Application Provider

Suitable for those issuing few invoices, this method is straightforward but can be time-consuming.

Option 2: Direct integration from your ERP to Peppol

Enterprises with in-house IT can integrate their ERP or invoicing system directly to the Peppol eDelivery network and issue in Peppol BIS Billing 3.0 (EN 16931). This avoids manual work and supports cross-border interoperability across the EU.

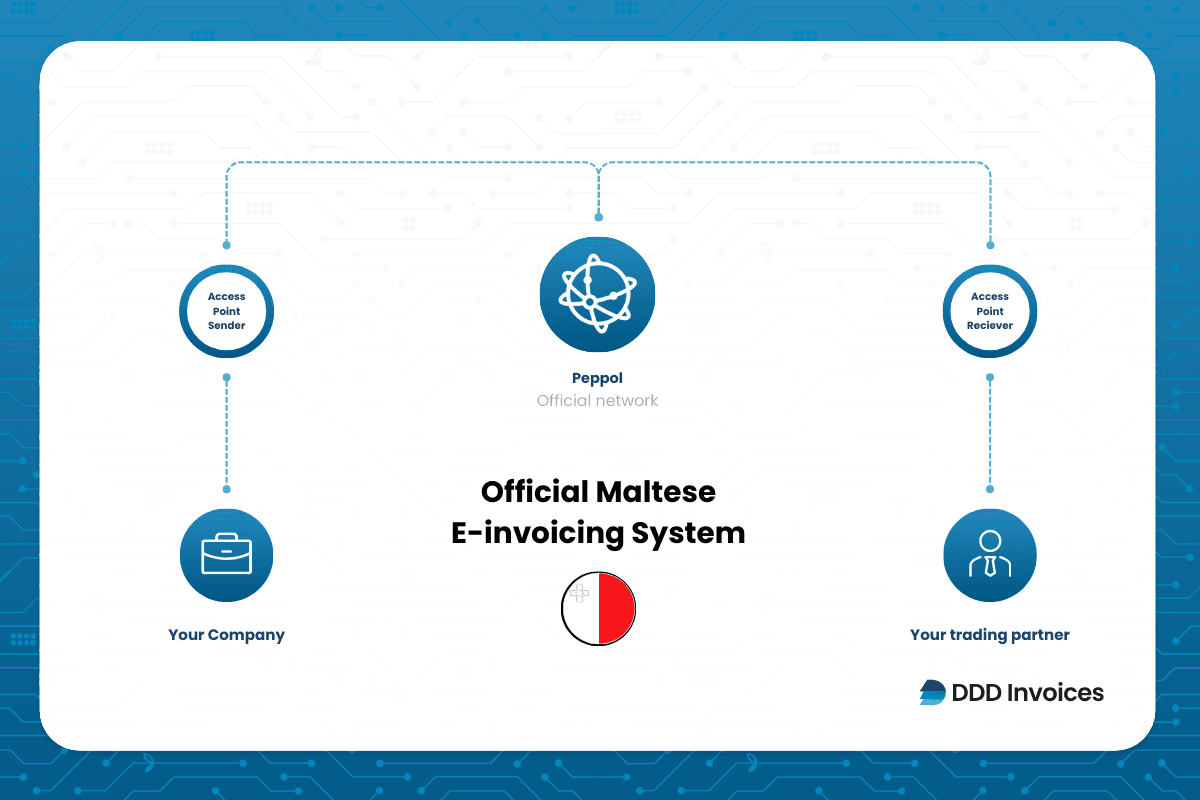

Businesses can connect to the Peppol network through Peppol Access Points (AP), such as DDD Invoices. A certified AP simplifies sending e-invoices between organizations by acting as a bridge between different ERP systems, transaction types, and local regulations.

Malta requires periodic VAT and financial reporting, mostly monthly or quarterly, and occasionally annually. Filing is usually electronic, except for companies with fewer than 10 employees and has to be done by the 15th of the second month after the reporting quarter, or by the 15th of the month following, if tax reporting is done monthly.

Vat registration thresholds are:

There is no double taxation, as non-residents supplying B2B goods or services domestically to VAT-registered customers do not need to VAT register. Instead, the business customer takes on the VAT obligations.

Right now, Malta’s penalty framework is still largely centered around VAT and tax reporting compliance; however, with the upcoming ViDA regulations and the move toward mandatory e‑invoicing, this is expected to change.

Here are a couple of examples of fines for non-compliance with invoicing and accounting obligations:

For a deeper look into Malta VAT and invoicing non-compliance penalties, click here.

Since the introduction of EN 16931 standards, Malta has advanced steadily toward a digital invoicing ecosystem, using formats such as Peppol BIS 3.0.

This e-invoicing system will speed up your invoice creation and issuance processes, reduce manual errors, and ensure compliance with e-invoicing, as well as legal archiving regulations.

We DDD Invoices also standardize your e-invoice creation for all B2B, B2C and B2G transactions, connect you directly to Peppol, and handle your whole process, from invoice creation, submission to receiving, and later securely archiving.

Whether you’re a software provider or a business, DDD Invoices helps you stay compliant and focus on growing your business without worrying about technical or compliance complexities.

Still have questions?

In the 30min free call we will discuss:

Not yet for B2B or B2C transactions. It is only required for public authorities to accept e-invoices in procurement above EU thresholds.

Malta supports Peppol BIS Billing 3.0 and UBL, both based on the EN 16931 standard.

The Malta Tax and Customs Administration (MTCA) regulates compliance and implementation.

Invoices, electronic or paper, must be retained for at least six years after the transaction’s financial year.

Currently, penalties are limited and focus on VAT compliance, but stricter rules with administrative fines and interest charges are expected under EU VAT in the Digital Age reforms.

By adopting EN 16931-compliant solutions early, integrating with Peppol, and maintaining robust digital records.

A great long-term solution are Peppol Access Point providers, as they track the regulations, implement changes and streamline the process for you.

As of 22.10.2025, B2B e-invoicing is mandatory or planned in the next 1-2 years in Italy, Hungary, Albania, Serbia, Romania, Poland, North Macedonia, Belgium, France, Spain, Latvia, Croatia, Slovakia, Slovenia, Montenegro and Germany.

Written by the Compliance team

Reviewed by Denis V. P.