B2G E-Invoicing in the Netherlands

Last modified on 08 August 2023 in Countries

Standard

Peppol BIS 3.0

Tax Portal

DIGIPOORT

Tax Authority

Ministry of the Interior and Kingdom Relations

CTC Model

Post-audit

B2G

2017

B2B

n/a

Archiving

7 years, 10 years (immovable property)

Pending DDD Invoices support

The Dutch government has implemented e-invoices in the public sector for B2G transactions due to the EU e-invoicing Directive 55/2014/EU and VAT in the Digital Age (ViDA) proposal according to the European standard EN 16931.

The Dutch central government receives over 1.6 million invoices from its suppliers every year and e-invoicing has made the manual process more efficient through benefits such as automation and digitalization.

Electronic invoice implementation timeline

-

1 January 2017: All central government suppliers must process and send e-invoices.

-

1 January 2019: All sub-central government suppliers must process and send e-invoices.

Dutch e-invoicing regulations

Scope

Currently, e-invoicing requirements only extend to B2G transactions, while B2B e-invoicing remains voluntary.

E-invoice characteristics

The following data must be included in a valid e-invoice:

-

Date of invoice and supply

-

Unique invoice number

-

Supplier's company info

-

Client's info

-

Description, quantity and cost of goods & services

-

Discounts or rebates

-

Total amount payable

-

Payment terms

Formats

The different Dutch formats used for e-invoicing have very different purposes, which are as follows:

Peppol BIS 3.0

This format is used for cross-border interoperability between countries that also use the Peppol network.

UBL-OHNL

This format is used by the Dutch government for goods and service procurement (excluding the hiring of employees).

SETU (HR-XML)

This format is used for the hiring of employees.

NLCIUS

This is a specification unique to the Netherlands that can be used for B2B e-invoicing.

Basis Invoice Rijk (BFR)

This format is used only within the central government.

Authentication

A digital signature is not required for e-invoices in the Netherlands.

Archiving

The majority of e-invoices must be stored for 7 years, while e-invoices concerning immovable property must be stored for 10 years.

3 Ways to send e-invoices in the Netherlands (B2G)

1. Peppol network

Sending invoices through a Peppol Access Point (AP), such as DDD Invoices, is the preferred way of e-invoicing. The AP connects to the national government and automatically converts a Peppol invoice into the correct government format. It is then simply sent via the Digipoort portal to the correct government agency.

2. Digipoort

Digipoort is an ICT center that does the processing for the government, and a direct link with the portal can be technically demanding. Therefore, large corporations that have an ICT infrastructure and a large volume of invoices will use this method.

3. Central government e-invoicing portal

This method is much more inefficient, as invoice data must be manually inputted into the portal, which can be prone to mistakes. Despite that, for those who issue fewer invoices, this method may be suitable.

B2B and B2C e-invoicing

The Netherlands' current government is likely to not impose a B2B and B2C e-invoicing mandate. This is because they have a low level of domestic VAT fraud compared to other European nations, and thus, for the foreseeable future, they will continue to make it voluntary for businesses.

Nederlandse Peppolautoriteit (NPa)

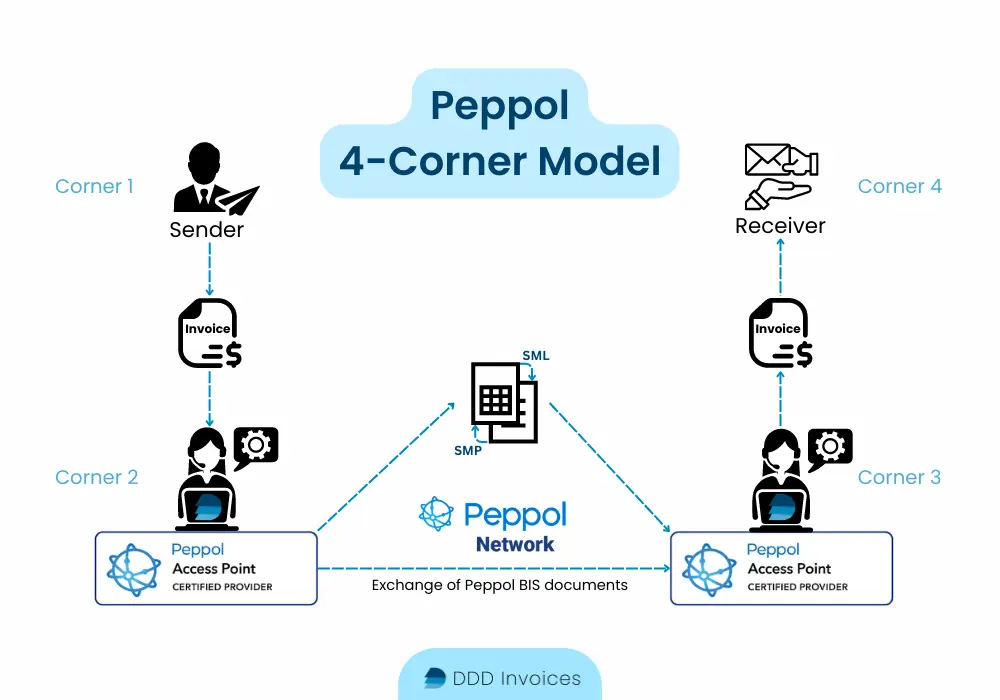

Peppol (Pan-European Public Procurement Online) serves as a network framework that streamlines the electronic exchange of documents, mainly focusing on e-invoicing, connecting businesses and government bodies. It functions based on established standardized specifications and protocols, ensuring smooth and secure interaction among participants via a 4-corner model.

The Netherlands Peppol Authority was formed on 1 October 2020 by the Dutch government. Businesses are able to connect to it through Peppol Access Points (AP), such as DDD Invoices. A certified AP simplifies sending e-invoices between organizations by acting as a bridge between different systems. It converts the sender's e-invoice into a Peppol BIS billing 3.0 format that the recipient's system can interpret.

DDD Invoices: a certified Peppol Access Point provider and e-invoicing solution

Want to connect to Peppol and don't know how? Here are the benefits of choosing DDD Invoices as your Peppol Access Point:

-

Unlock the ability to send and receive e-documents worldwide, without worrying about local compliance issues. Through our API, we automatically fill in your invoice data and send the invoice to the proper authorities, letting you focus on your core business processes and we manage the bureaucracy.

-

Seamlessly integrate into your current invoicing system, ERP or CRM in as little as one day. Enjoy an error-free and automated invoicing process through our secure and reliable service.

FAQs about e-invoices in the Netherlands

Who must issue an electronic invoice in the Netherlands?

How can I achieve B2G e-invoicing compliance in the Netherlands?

What is Nederlandse Peppolautoriteit (NPa)?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API