All about B2B e-invoicing in France

Last modified on 26 May 2023 in Countries

Standard

UBL, CII or Factur-X

Tax Portal

Chorus Pro (PPF)

Tax Authority

Direction Générale des Finances Publiques

CTC Model

Decentralised Clearance Model

B2G

2017

B2B

July 2024 - 2026

Archiving

10 years

Pending DDD Invoices support

In France, the adoption of electronic invoicing has gained momentum in recent years. The government has recognized its potential to streamline administrative processes, reduce the value-added tax (VAT) gap, improve tax compliance, and boost overall economic productivity through new e-invoicing and e-reporting obligations.

In France, B2G e-invoicing has been mandatory since 2017. B2B invoicing is currently voluntary, but will become mandatory in phases for different groups from 2024 until 2026. Continue reading to learn more about all of the essentials required to become VAT compliant in France.

Latest News

Technical guidelines for B2B e-invoicing and e-reporting in France were updated on March 31, 2023, by the French Directorate General of Public Finance (DGFP).

In April 2023, the registration process for Chorus Pro or Portail Public de Facturation (PPF), the French public invoicing portal, opened for companies who register directly or through potential certified agents (PDPs).

French e-invoice legislation timeline

-

1 January 2024 - 6-month pilot program launch for businesses and PDPs on a voluntary basis

-

1 July 2024 - Mandatory e-invoicing and e-reporting for B2B and B2C in large corporations with over 5,000 employees and €1.5 billion annual revenue or more than €2 billion balance sheet total

- Note: Companies who do not have to send e-invoices yet, must be ready to receive e-invoices at this time

-

1 January 2025 - Mandatory for SMEs with fewer than 5,000 employees and annual sales of less than €1.5 billion or balance sheet total of less than €2 billion

-

1 January 2026 - Mandatory for all SMEs and very small enterprises (VSEs) with fewer than 250 employees and annual sales of less than €50 million or a balance sheet total of less than €43 million

Who is affected by the e-invoicing mandate in France?

Obligated issuers

-

International and domestic B2B transactions subject to VAT

-

B2C transactions (only for e-reporting)

-

B2G transactions

-

Local and foreign companies established and registered for VAT in France

Penalties

The French tax administration is enforcing the use of electronic invoicing through non-compliance fees which are €15 per invoice with a maximum of €15,000 per year for taxpayers. There is also a penalty for non-compliant certified agents at €15 per transmission, with a maximum of €45,000 per year.

France also has e-reporting non-compliance penalties which start from €250 per invoice with a yearly maximum of €45,000.

Chorus Pro - Public Billing Platform (PPF)

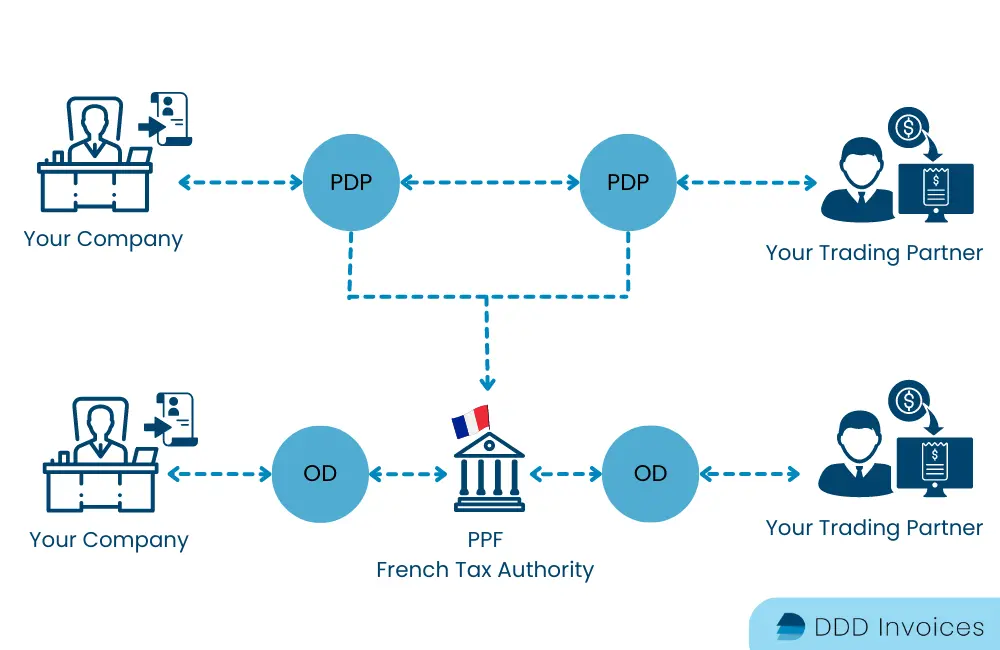

Chorus Pro serves as the official government platform and invoicing portal for entities to interact with tax authorities in France. It enables communication through well-established and efficient traditional EDI channels and formats that have undergone thorough testing and validation. These certified agents will represent intermediaries between suppliers and clients in what is nicknamed the "Y-model."

France is going to utilize a decentralized clearance model where invoices are sent to the government and businesses at the same time. It uses Continuous Transaction Controls, which are already used in Mexico and Chile, and companies can choose to use plateformes de dématérialisation partenaires (PDPs) or agents certified by the government to send e-invoices directly to recipients.

Companies can also choose to use dematerializing operators (ODs) which are not authorized to directly send to the invoice recipients, but must connect to the PPF or PDP in order to complete the process.

Specifications

Companies operating in France have a range of accepted electronic formats including UBL, C2I, and Factor-X. Unlike countries such as Poland, Serbia and Italy, a readable PDF must also be attached to satisfy technical requirements.

Included details:

-

SIREN number - the identification number of a taxpayer established in France

-

Transaction identification - whether it qualifies as a good, service or mixed service

-

Complete delivery address

Throughout the changes to invoicing, the audit trail documentation will remain unchanged along with the authenticity of origin and other e-invoice requirements. A digital signature is also not mandatory for now.

Objectives

-

Simplify tax reporting and increase competitiveness through decreased bureaucracy and payment times, with increased automation

-

Improve transparency to minimize fraud

-

Optimize business activities and credit approval through real-time capital tracking

-

Decreased invoicing costs

Summary of e-invoicing in France

The move towards widespread electronic invoicing in France aims to achieve multiple goals. Firstly, it aims to address the significant VAT gap, which currently stands at around €13 billion. By implementing it, the government aims to reduce tax evasion and improve overall tax compliance.

Additionally, the shift to e-invoicing is expected to provide significant benefits to businesses. It will help reduce invoice and payment processing costs, as well as streamline administrative processes, thereby improving productivity and efficiency.

To comply with the requirements, businesses need to ensure that their invoicing systems meet the technical specifications set by the French tax authorities. They should generate e-invoices that include all the necessary information, validate them against the established standards, and keep up to date on the latest requirements which may change over the next few years.

How DDD Invoices can help

DDD Invoices simplifies electronic invoicing in France by providing a solution that integrates into your existing software through a single API. This allows companies to automate the invoicing process and satisfy French VAT e-invoicing obligations on the PPF platform. We handle e-invoice creation, distribution, and archiving, allowing you and your clients to send and receive e-invoices seamlessly within your existing software.

We stay up to date with local tax regulations so you don't have to. Comply with mandatory e-invoicing with ease and if we do not currently serve a territory where you require e-invoicing, let us know, and we can develop it in 2-3 weeks. This way, we can ensure VAT compliance at all times, wherever you do business.

FAQs about VAT e-invoicing requirements in France

What is required for a VAT invoice in France?

When will B2B electronic invoicing be mandatory in France?

Where to issue e-invoices in France?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API