All about B2B e-invoicing in Serbia (Mandatory in 2023)

Last modified on 20 June 2023 in Countries

Standard

UBL 2.1

Tax Portal

SEF

Tax Authority

Ministartstvo Finansija

CTC Model

Central Platform Exchange

B2G

1 May 2022

B2B

1 Jan 2023

Archiving

10 years

Supported by DDD Invoices

E-invoicing has become mandatory in the Republic of Serbia, making it one of the first countries in Europe to make paper invoices extinct. This mandate was rolled out in three stages throughout 2022 and 2023.

In this article, we will delve into the specifics of e-invoicing in Serbia, covering its implementation process, legal framework, mandatory requirements, and our solution, which over 30+ Serbian companies use for e-invoicing.

Latest news

Serbia has completed the transition to e-invoicing, for both B2B and B2G transactions. Businesses must comply with the legislation going forward. No further e-invoice changes are expected at this time.

Implementation timeline for e-invoices in Serbia

Serbia adopted the Law on Electronic Invoicing - Zakon o Elektronskom Fakturisanju that mandated the use of e-invoices for all businesses from 1 January 2023 onward.

The legislation was introduced in three phases:

1 May 2022: All invoices sent to public authorities have to be sent as e-invoices and the Serbian government must be able to receive and store them electronically. (G2G/B2G)

1 July 2022: All public sector entities are required to send e-invoices to companies, which must be able to receive, process and store incoming invoices. (G2B)

1 January 2023: E-invoicing will be mandatory in the entire B2B sector, meaning all private sector entities are obliged to send and receive e-invoices. (B2B)

E-invoicing requirements in Serbia

With the passing of a new law on electronic invoicing, B2B and B2G e-invoicing is now required. The Serbian Law on Electronic Invoicing - Zakon o Elektronskom Fakturisanju requires VAT-liable companies to implement e-invoicing to trade with partners (other businesses and the government). This applies to domestic and foreign businesses with a local fiscal representative that does business with Serbian VAT payers.

Companies must issue, receive, and store e-invoices according to local regulations. For Serbs, this means finding an electronic invoice system that supports the Serbian standard and can access the SEF network. Businesses must also archive e-invoices for a legally determined period of 10 years.

Businesses must also follow the Universal Business Language Format 2.1 (UBL 2.1) which is similar to the XML format.

Exemptions

The only exceptions to the electronic invoicing obligation are flat-rate taxpayers who are not VAT-liable and are not public sector suppliers. While they are exempt from the obligation, they may still use e-invoicing voluntarily. Flat-rate taxpayers who register voluntarily must continue e-invoicing via SEF for 2 years before they can switch back to traditional e-invoicing regulations.

Penalties

Businesses that fail to comply with the new e-invoicing requirements face penalties of 50.000 to 2.000.000 RSD. Legal entities - private and public, entrepreneurs, information intermediaries, and their responsible individuals - can all be subject to fines.

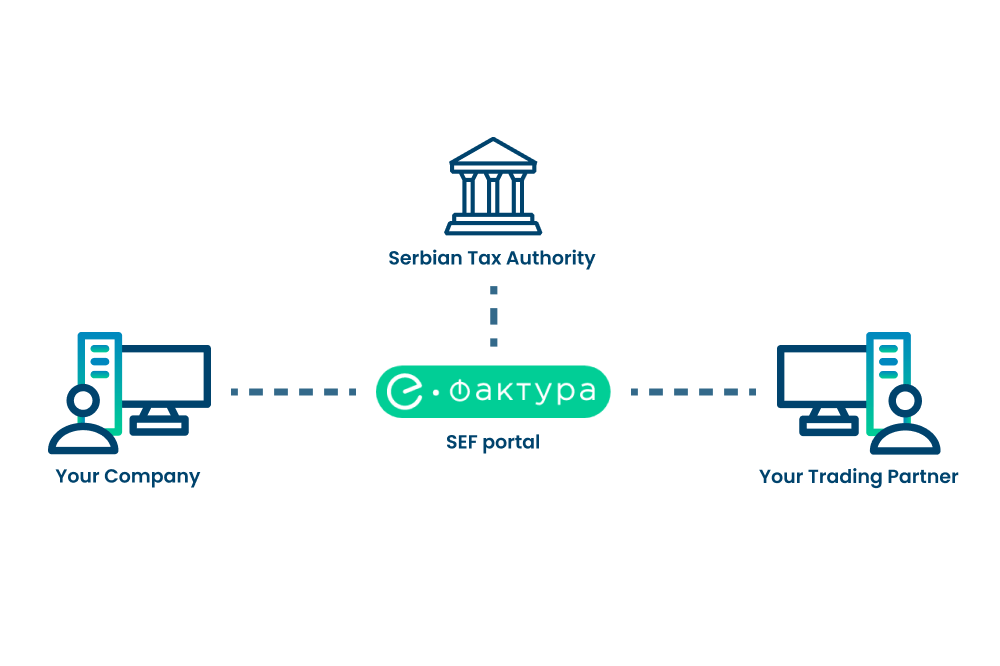

SEF e-invoicing platform and the Central Clearance Model

Serbia uses the Central Clearance Model of e-invoicing. In this model, the national tax authority manages a central platform where businesses send and retrieve e-invoices. This central platform authenticates e-invoices and stores tax data.

In Serbia, the central platform for e-invoicing is Sistem Elektronskih Faktura (SEF) or Sistem e-Faktura, which is managed by the Serbian Ministry of Finance. The e-invoicing process via this platform takes place as shown below:

3 Methods for creating and sending e-invoices to SEF

1. e-Faktura/SEF

On the e-Faktura website, sellers can manually enter invoice data to create e-invoices. Each e-invoice requires the issuer to reenter data from scratch since the site does not save any invoice data.

This method is free, however, many users dislike reentering the same data several times and are frustrated by the site's frequent crashes.

Learn how to register for SEF here.

2. Web e-invoicing

Sellers can issue e-invoices using an e-invoicing web app. Using a web app is a more time-efficient method than e-Faktura since it saves certain invoice data (i.e. item lists and buyer/ seller information). So instead of starting from scratch, you can simply auto-fill data to create e-invoices.

3. E-invoicing software integration

Using an integrated electronic invoicing solution, the seller can forward e-invoices directly from the software they already use for invoicing. Since the solution is integrated into the existing software, it can automatically create, send, receive, and archive all electronic invoices, removing any manual work involved in the other methods. DDD Invoices is one such software integration that allows users to effortlessly manage their e-invoicing through a single API.

The challenges of Serbian e-invoicing

The Serbian electronic invoicing platform has been difficult and inefficient to use from the very start of its operation. Users are dissatisfied with its performance, reporting frequent site lag and crashes. Using the site to issue and receive e-invoices also requires the issuer to manually enter data multiple times. So users have to enter data once to create the invoice, and once more in the SEF form to create an e-invoice. Users often state that they find this multi-stage entry process to be redundant, tedious, and time-consuming.

How DDD Invoices can help

DDD Invoices simplifies electronic invoicing for companies by providing a solution that integrates into their existing software. This allows companies to automate the invoicing process and eliminate the need for manual data entry amongst many other benefits. We handle e-invoice creation, distribution, and archiving, allowing you and your buyers to send and receive e-invoices seamlessly within your existing software.

We stay up to date with local tax regulations so you don’t have to. We have already established a compliant network in several countries, including Serbia. If we do not currently serve a territory where you require e-invoicing, let us know, and we can develop it in 2-3 weeks. This way, we can ensure your VAT compliance with e-invoicing at all times, wherever you do business.

Conclusion

Serbia was one of the first European countries to implement mandatory B2B e-invoicing, taking a step towards improving business processes and tax transparency. As one of the first countries to do this, they are still ironing out the wrinkles in their system, hoping to improve the site issues many users currently experience. Most users have turned to third-party web apps and integration solutions to avoid issues with the government-provided system. Integrations like DDD Invoices have significantly reduced the time and effort required for e-invoicing, making it the preferred solution among businesses.

FAQs about e-invoicing in Serbia

Who is obliged to issue an e-invoice in Serbia?

Where to transmit e-invoices in Serbia?

When is it mandatory to start sending e-invoices in Serbia?

Who is exempt from the Serbian e-invoicing obligation?

What is the best e-invoicing program in Serbia?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API