Mandatory E-Invoicing in Sweden

Last modified on 10 August 2023 in Countries

Standard

Peppol BIS 3.0

Tax Portal

n/a

Tax Authority

Skatteverket

CTC Model

Post-audit

B2G

2008

B2B

n/a

Archiving

7 years

Pending DDD Invoices support

Electronic invoicing in Sweden began in 2008 with mandatory electronic invoice usage for B2G transactions with central government authorities. This expanded in 2019 to encompass all public administrations and is preparing to enforce B2B e-invoicing in the future. In the same realm, Sweden is also likely to begin a real-time reporting and Continuous Transaction Control (CTC) mechanism soon.

Latest news

The Swedish Agency for Digital Government (DIGG) is now encouraging the transition from using the Svefaktura national format to Peppol BIS 3.0 to improve cross-border trade.

E-invoice implementation timeline

-

2008: Mandatory e-invoicing for central public administrations.

-

1 April 2019: Mandatory B2G e-invoicing for all public administrations and mandatory use of the Peppol network and Peppol BIS 3.0 format, which follows the EN 16931 standard.

Digital reporting requirements

Sweden is another country that utilizes hardware-based fiscalization, which is based on the fiscal device-control unit or control system. This Skatteverket government-certified device's main purpose is to sign and store transactions. It receives data from the cash register, which will then produce a control code that is placed on the fiscal receipt and then sent to the government.

Sweden is likely to advance its reporting requirements with the likely implementation of real-time reporting and a CTC system in the future.

Electronic invoice requirements

Scope

Since 2008, suppliers to the central government have had to issue e-invoices. This legislation was expanded to encompass all government entities in 2019. A B2B e-invoicing mandate is expected in the future.

Format

E-invoices are recommended by the DIGG to use the Peppol BIS billing 3.0 format as the Svefaktura is being phased out. In the public sector, Peppol BIS 3.0 is the only accepted format since it is compliant with EN 16931.

Full VAT invoice

-

Invoice issuance date

-

Unique invoice identification number

-

Supplier's Swedish VAT number

-

Complete addresses of supplier & customer

-

Full description of provided goods & service

-

Quantity of goods, if relevant

-

Unit prices, if relevant

-

Reference to reverse charge mechanism, if relevant

-

Details of fiscal representative, if relevant

-

Supply date if different from invoice date

-

Net taxable value of the supply

-

VAT rate(s) applied, with VAT amount per rate

-

Total VAT amount in SEK (unless EUR is accounting currency)

-

Total gross invoice amount

Note: A simplified invoice may be used for certain circumstances

Validation

An electronic signature is not required for an e-invoice to be compliant, but may be used voluntarily.

Storage

E-invoices need to be stored for 7 years in a secure archive in case of an audit.

Peppol

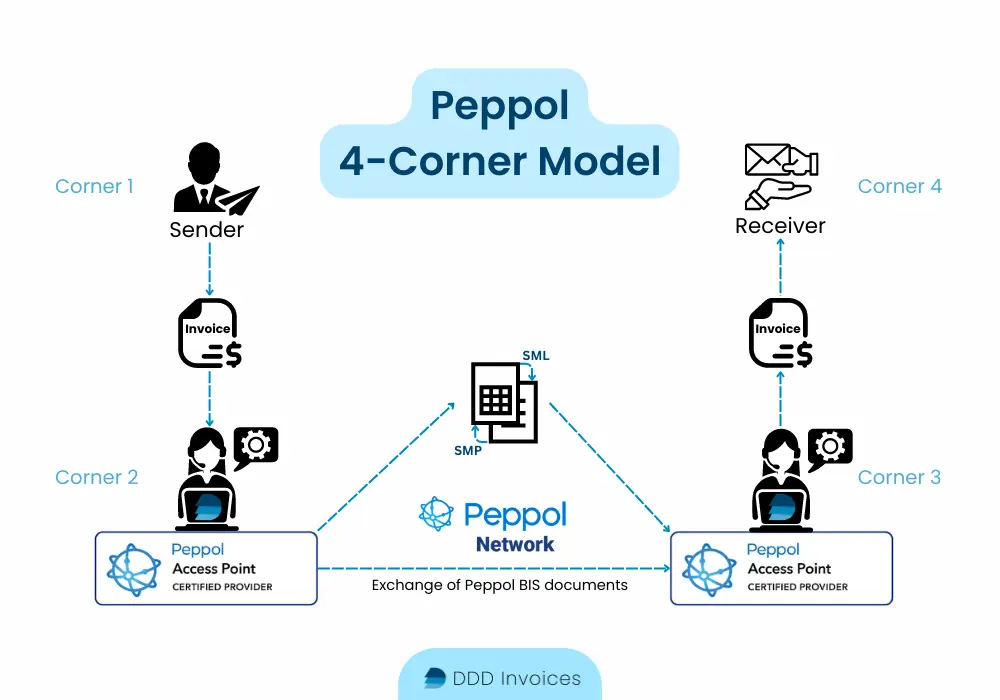

Peppol (Pan-European Public Procurement Online) serves as a network framework that streamlines the electronic exchange of documents, mainly focusing on e-invoicing, connecting businesses and government bodies. It functions based on established standardized specifications and protocols, ensuring smooth and secure interaction among participants via a 4-corner model.

From 1 April 2019, entities in public procurement had to process and issue e-invoices through the Peppol network. They also had to switch from other formats to the Peppol BIS 3.0 standardized format.

DDD Invoices: a certified Peppol Access Point provider and e-invoicing solution

Want to connect to [Peppol] and don't know how? Here are the benefits of choosing DDD Invoices as your Peppol Access Point:

-

Unlock the ability to send and receive e-documents worldwide, without worrying about local compliance issues. Through our API, we automatically fill in your invoice data and send the invoice to the proper authorities, letting you focus on your core business processes and we manage the bureaucracy.

-

Seamlessly integrate into your current invoicing system, ERP or CRM in as little as one day. Enjoy an error-free and automated invoicing process through our secure and reliable service.

Benefits of e-invoicing and online fiscalization

There are many benefits to e-invoicing that entities can capitalize on:

-

Automation - This can aid in reducing human error, speeding up the process, and allowing employees to focus on fewer routine tasks.

-

Cost savings - E-invoicing can help save over 60% of the time and money spent on paper invoices.

-

Compliance - Through utilizing a service provider such as DDD Invoices, companies do not have to create their own e-invoicing system and do not have to deal with the bureaucracy that comes with both of these processes.

FAQs about e-invoicing compliance in Sweden

Who must send e-invoices in Sweden?

What format should I use for Swedish e-invoices?

How can I connect to the Peppol network?

Businesses are able to access the Peppol network by working with registered Peppol Access Points (APs). They then link your company to the network by enabling the sending of e-invoices. In order to receive them, a unique Peppol ID must be obtained.

You're in luck! DDD Invoices is a trusted Peppol Access Point provider and can assist you in meeting your invoicing requirements. Learn more here."Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API