E-Invoicing in Malta

Last modified on 05 August 2023 in Countries

Standard

Peppol BIS 3.0

Tax Portal

n/a

Tax Authority

Ministeru Għall-Finanzi

CTC Model

Post-audit

B2G

2020

B2B

n/a

Archiving

6 years

Pending DDD Invoices support

E-Invoicing, also known as electronic invoicing, is a contemporary method that allows businesses to exchange invoices in a structured digital format. Malta has recently adopted this approach, recognizing its many benefits.

The Government of Malta strongly supports the widespread use of eInvoicing as a part of its Digital Malta national strategy. This initiative is also a result of its participation in the EU Funded eInvoicing4Islands project as well as Directive 2014/55/EU.

Implementation timeline

-

2018: Transposition of the e-invoicing Directive through Legal Notices 403 and 404 under the Financial Administration and Local Councils Act.

-

April 2020: All central government entities must be able to process and receive e-invoices.

E-invoicing compliance in Malta

Scope

E-invoicing is mandatory in the B2G environment. E-invoices for B2B and B2C transactions are not included in the scope, but are regulated.

Invoicing portal

Although there is no central platform for e-invoicing, Malta is currently in the implementation phase of a Corporate Financial Management Solution (CFMS) which should be coming soon.

Archive

E-invoices must be stored for 6 years.

Authenticity

Maltese e-invoices require an electronic signature in order to be compliant and ensure the integrity of the data.

Simplified e-invoice components

A simplified invoice can be used when the invoiced amount does not exceed 100 EUR and should include the following the data:

-

Invoice date

-

Unique serial number

-

Provider information: name, address, and VAT number

-

Recipient's VAT identification number

-

Description of goods/services

-

Total VAT payable or details for calculation

Regular e-invoice components

-

Date of issue

-

Unique serial number

-

Supplier information: name, location, and VAT identification number

-

Recipient information: name, address, and VAT identification number (if applicable)

-

Description of goods/services supplied

-

Date of supply or payment on account

-

Price per unit (exclusive of VAT), discounts, and currency used

-

Applied VAT rates

-

VAT amount due

-

"Cash Accounting" notation for VAT chargeable at the time of payment under Parts 1 and 3 of the VAT Schedule

-

"Self-billing" notation if the customer is issuing an invoice to itself

-

"Reverse-Charge" notation if the customer pays VAT

-

"Triangulation Transaction – Article 141 EC Council Directive 2006/112/EC – Reverse Charge" notation for invoices issued in accordance with the triangular transaction simplification scheme by intermediaries

-

Notation for invoices related to supplies on which no tax is chargeable, providing reference to relevant sections of the VAT Act or reasons for no tax charge (e.g., EU legislation)

Maltese digital reporting requirements

Currently, in Malta, eInvoicing is not utilized for Value Added Tax (VAT) digital reporting. As a result, VAT-taxable individuals are not required to regularly or continuously submit transaction data in a digital format.

Peppol

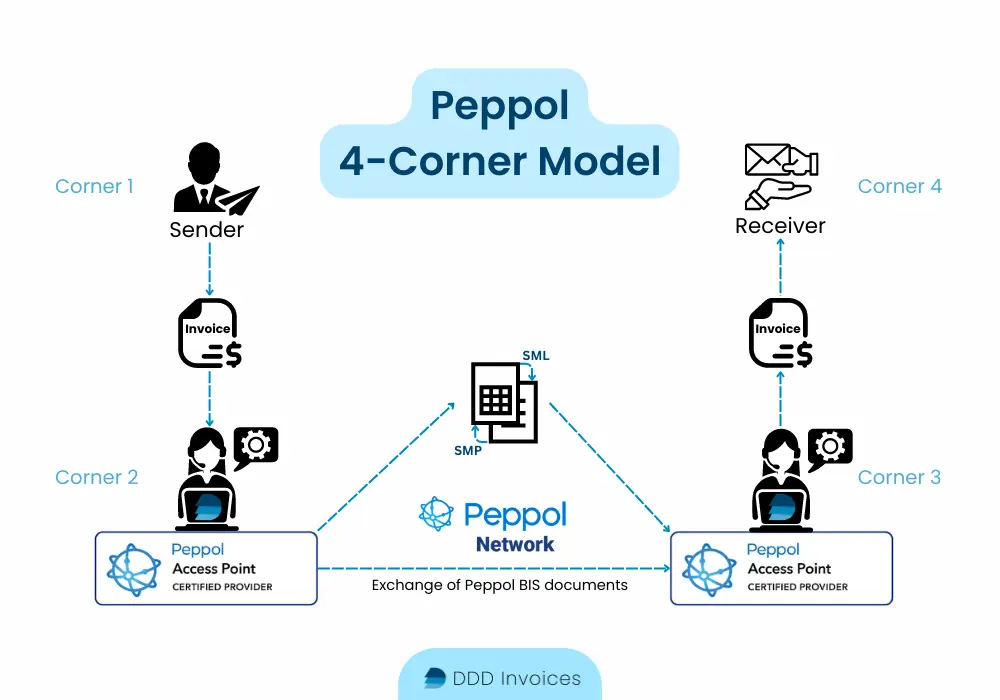

The Peppol delivery network serves as the foundation for Malta's e-invoicing system. Since there is no central platform, companies can send and receive invoices using any e-invoicing program compatible with the Peppol network.

DDD Invoices: a certified Peppol Access Point

Want to connect to Peppol but don't know how? Here are the benefits of choosing DDD Invoices as your Peppol Access Point:

-

Unlock the ability to send and receive e-documents worldwide, without worrying about local compliance issues. Through our API, we automatically fill in your invoice data and send the invoice to the proper authorities, letting you focus on your core business processes and we manage the bureaucracy.

-

Seamlessly integrate into your current invoicing system, ERP or CRM in as little as one day. Enjoy an error-free and automated invoicing process through our secure and reliable service.

FAQs about e-invoicing in Malta

Is Maltese B2G e-invoicing mandatory?

What are the digital reporting requirements in Malta?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API