B2B e-invoicing in Germany (New electronic invoice mandate 2026)

Last modified on 21 July 2023 in Countries

Standard

xRechnung, ZUGFerD

Tax Portal

ZRE, OZG-RE

Tax Authority

Bundesministerium der Finanzen

CTC Model

To be announced

B2G

2020 - phased

B2B

2026

Archiving

10 years

Pending DDD Invoices support

Germany is currently in a digitalization transition period after the European Commission's ViDA proposal. Many changes are quickly approaching for both B2G and B2B transactions with paper invoices being replaced with e-invoices.

A new e-invoicing mandate has already been set in the B2G sector, with mandatory B2B electronic invoicing scheduled to begin on January 1st, 2026. Read on to learn the important facts and changes to invoicing in Germany.

Latest news

Germany has rescheduled the proposed e-invoicing deadline from January 2025 to January 2026. This is due to the Bundesministerium der Finanzen (BMF) revised proposal of the Growth Opportunities Act following a public consultation in May 2023.

Legislation timeline

B2G e-invoicing

-

18 April 2020 - Contractors and government suppliers must be able to receive and process e-invoices

-

27 November 2020 - Mandatory issuance of e-invoices at the federal level in the state of Bremen

-

1 January 2022 - Mandatory in the states of Saarland, Hamburg and Baden Württemberg

-

1 April 2023 - Mandatory in the state of Mecklenburg-Western Pomerania

-

1 January 2024 - Mandatory in the state of Rhineland-Palatinate

-

18 April 2024 - Mandatory in the state of Hessen

B2B e-invoicing

- 1 January 2026 - Planned phased implementation of B2B e-invoicing

XRechnung format

The XRechnung format is used for B2G e-invoicing which can be used for the Peppol network as well as many other aforementioned platforms similar to Belgium and France. This format is required for sending e-invoices to the German government administration and is a pure data record.

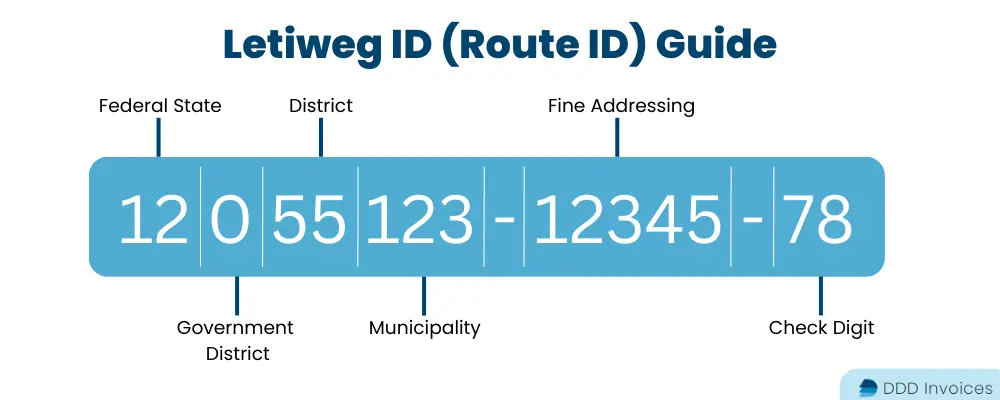

An essential element of the xRechnung format is the Letiweg ID or routing ID. This is composed of elements such as a state code (Kennzahl des Regierungsbezirks), fine addressing (Feinadressierung), and a check digit (Prüfziffer). An additional benefit to this format is that it can be also used to transmit invoices through the European Peppol network.

ZUGFerD 2.0 format

The ZUGFerD 2.0 is a hybrid format that combines structured invoice data in an embedded XML format with a PDF document. It is currently used for voluntary B2B invoicing as xRechnung is now the only valid format for B2G invoices.

Both the xRechnung and ZUGFeRD formats are compliant with the European Union's ViDA proposal and the European standard EN 16931.

Steps for after an e-invoice is sent

1. Track submission status

This can be monitored until the invoice has been collected by the customer.

2. Portal checks the invoice for compliance

Make sure that the submitted invoice conforms to the XRechnung specification or other approved European standards, such as ZUGFeRD 2.0, in both syntax and semantics.

3. Automatic forwarding

If an invoice passes the conformity check, it will be automatically processed and forwarded to the client by the invoicing portal.

Businesses can also decide whether to receive a notification when an invoice status changes to maintain an overview of the invoice status.

Platforms for B2G e-invoices at the Federal State level

The type of e-invoicing platform used in Germany significantly is impacted by the state to which an e-invoice must be sent. Some states have decided to share a platform while others have decided to set up their own portal. The majority of portals have decided to feature a Peppol interface to prepare for the future while others have set up an email interface for transmission.

ZRE - Zentrale Rechnungseingangsplattform

The ZRE is used as a direct B2G electronic invoice receipt portal for the federal government for the receiving and processing of e-invoices and has been used since 2018. The ZRE also gives users the option of sending invoices through the Peppol network.

Only the xRechnung format is accepted to use the portal. Entities or individuals can access the platform through a one-time registration, free of charge, but over time, some expenses are charged through its usage.

The ZRE has 3 main responsibilities:

-

Processing of e-invoices through various transmission channels

-

E-invoice compliance checking

-

E-invoice compliance checking

OZG-RE - Onlinezugangsgesetz-konforme Rechnungseingangsplattform

The federal OZG-RE (Online Access Act-compliant Invoice Submission Portal) is a portal for indirect federal administration institution suppliers which has been available since December 2022. Many states use the OZG-RE, but due to e-invoicing being conducted at the state level, a majority of them have created private platforms.

OZG-RE is used by states of:

-

Berlin

-

Brandenburg

-

Saxony

-

Thuringia

-

Mecklenburg-Western Pomerania

This platform, similar to many other e-invoicing platforms worldwide, features a Peppol interface. Using the platform directly can be a time-consuming process. Thus, many companies are opting to switch to invoicing platforms such as the DDD Solution to automate the soon-to-be mandatory process.

German Peppol Authority

The state tax authorities are the ones who decide where to accept e-invoices as structured data such as Peppol or only through non-automated processes. The Peppol network is much more efficient and can be used with the German xRechnung or the Peppol BIS 3.0 format.

Peppol is also the current best way for companies who are new to e-invoicing to automate this process and empowers companies to capitalize on the benefits of structured electronic invoices. Therefore, when choosing an electronic invoicing provider, they must be certified to conduct Peppol transactions in Germany.

How DDD Invoices can help

Electronic invoicing in Germany utilizes Peppol which is integrated with the OZG-RE government platform. Businesses can connect to Peppol through certified Peppol Access Points such as DDD Invoices.

DDD Invoices simplifies e-invoicing for B2B transactions by providing an e-invoicing solution that integrates into their existing software. This allows companies to automate the invoicing process and eliminate manual data entry.

We stay up to date with local tax regulations so you don’t have to. Comply with obligatory e-invoicing with ease through a single API and if we do not currently serve a territory where you require e-invoicing, let us know, and we can develop it in 2-3 weeks. This way, we can ensure your VAT compliance at all times, wherever you do business.

FAQs about B2B e-invoicing in Germany

Is e-invoicing mandatory in Germany?

Where to issue compliant electronic invoices via the Peppol Network in Germany?

Is an electronic signature required for B2B and B2G e-invoicing in Germany?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API