E-invoicing in Austria for Public Procurement

Last modified on 15 August 2023 in Countries

Standard

ebInterface, Peppol BIS 3.0

Tax Portal

Unternehmens-serviceportal

Tax Authority

Eidgenössische Steuerverwaltung

CTC Model

Post-audit

B2G

2014

B2B

n/a

Archiving

7 years

Pending DDD Invoices support

The use of electronic invoices in Austria began in 2014 with public procurement as it was mandatory for Austrian public entities to receive e-invoices in the European standard format EN 16931. E-invoicing is not mandatory for B2B transactions, but it is encouraged through the use of the Unternehmensserviceportal (USP) portal.

Latest Austrian e-invoice news

The USP does not accept e-invoices in the ebInterface 4.0, 4.1 or 4.2 format. Only the latest version of ebInterface 6.0 or 4.3 may be used.

E-invoicing timetable

-

2013: Voluntary B2B e-invoicing as electronic invoices gain the same standing as paper invoices through the ICT Consolidation Act (ICTKonG).

-

2014: Mandatory electronic invoice use for central public administrations in Austria.

-

2020: Mandatory electronic invoice use for federal states and municipal authorities.

Digital reporting requirements In 2016 Austria introduced the Fiscal Journal (DEP), which has to be stored in real-time at every point of sale (POS) system, in a central database, or in the cloud, and is then transmitted to the Bundesministerium Finanzen authorities on-demand.

Since 2017, they have also required a digital signature for cash receipts in order to further increase the security of the information. Thus, Austria’s fiscal system can be classified as hardware and software and companies must satisfy these digital reporting requirements. Through the SAF-T system utilized in many countries around the world, all companies must submit their tax reporting information digitally on demand.

E-invoicing regulations in Austria

Standard electronic invoice elements

- Invoice issuance date

- Unique invoice ID

- Supplier

- VAT number, full name and address

- Customer

- VAT number (if supply value is more than EUR 10,000), full name and address

- Description of exchanged goods or services as well as the quantities of goods

- Date of the supply if it is different from the invoice date

- The net, taxable value of the supply

- The VAT amount and individual VAT rates applied

- Total, gross invoice value

For supplies with a value below EUR 400, a simplified invoice may be used.

Scope

All federal government contractors, including those from abroad, are required to submit only structured electronic invoices for the delivery of products and services to government departments under the provisions of the "IKT Konsolidierungsgesetz". Private entities are currently not required to submit e-invoices, but may do so voluntarily.

Format

Invoice issuers may use the Peppol BIS 3.0 or ebInterface format for a compliant e-invoicing process and satisfy Austrian e-invoicing requirements.

Platform

Structured electronic invoices (eInvoices) can be delivered to other invoice receivers as well as the Austrian public sector via the Federal Service Portal Unternehmensserviceportal (USP).

Validation

An electronic signature is not required for e-invoicing compliance in Austria.

Storage

E-invoices must be stored for 7 years in case of an audit.

How to send an electronic invoice

Option 1: Manually via E-RECHNUNG.GV.AT.

This method is most appropriate for those who do not issue many invoices in Austria since the process is more time-consuming.

Option 2: Directly via USP

Registering for the central electronic invoicing platform Unternehmensserviceportal (USP) requires a digital signature which can be acquired through the use of an Austrian ID, mobile phone signature, or Bürgerkarte. Another option is to use an existing FinanzOnline account to log into USP. This can be done directly if an enterprise has the IT infrastructure required or via a service provider such as DDD Invoices.

Option 3: Via a Peppol Access Point

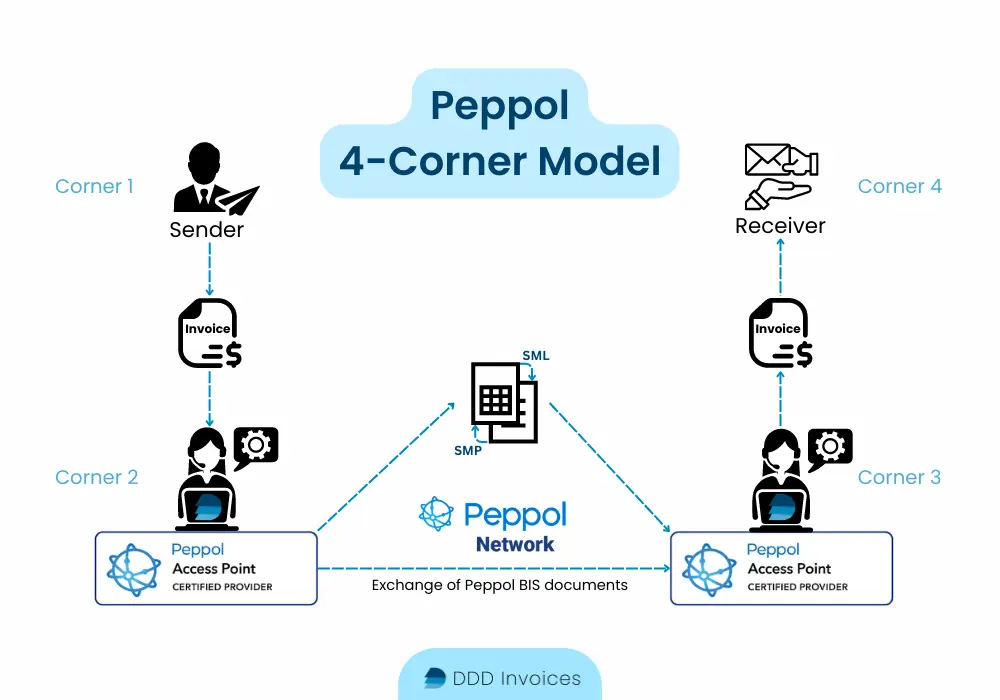

Peppol (Pan-European Public Procurement Online) serves as a network framework that streamlines the exchange of electronic invoices, connecting businesses and government bodies. It functions based on established standardized specifications and protocols, ensuring smooth and secure participant interaction via a 4-corner model.

Businesses are able to connect to the Peppol network through Peppol Access Points (AP), such as DDD Invoices. A certified AP simplifies sending e-invoices between organizations by acting as a bridge between different systems. It converts the sender's e-invoice into a Peppol BIS billing 3.0 format that the recipient's system can interpret.

DDD Invoices: a certified Peppol Access Point provider and e-invoicing solution

Want to connect to Peppol and don't know how? Here are the benefits of choosing DDD Invoices as your Peppol Access Point:

-

Unlock the ability to send and receive e-documents worldwide, without worrying about local compliance issues. Through our API, we automatically fill in your invoice data and send the invoice to the proper authorities, letting you focus on your core business processes and we manage the bureaucracy.

-

Seamlessly integrate into your current invoicing system, ERP or CRM in as little as one day. Enjoy an error-free and automated invoicing process through our secure and reliable service.

FAQs about e-invoicing in Austria

What is the future of e-invoicing in Austria?

Who must issue e-invoices in Austria?

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API

"Ready to save on development costs?"

Unlock globally compliant e-invoicing with a single API