E-Invoicing in Hungary (NAV RTIR)

Hungary’s E-Invoicing and Real-Time Reporting with Mandatory RTIR for B2G, B2B and B2C under Act CXXVII of 2007 and Act LXXXIII of 2018, Sector-Specific E-Invoicing for Energy from 2025, and XML 3.0 Transition.

Last modified on 2025-09-05 in Countries

UBL 2.1, UN/CEFACT CII, PEPPOL BIS 3.0 or Signed PD

NAV Online Szamla

Nemzeti Adó és Vámhivatal

Model n/a

n/a

n/a

8 years

Hungary is one of the most advanced countries in Europe when it comes to digital tax systems. In recent years, the NAV Online Számla system has changed how businesses handle invoicing and tax compliance. Hungary’s e-invoicing and real-time invoice reporting requirements are established by Act CXXVII of 2007 on Value Added Tax, which sets the rules for VAT and invoice data disclosure, and further strengthened by Act LXXXIII of 2018, which introduced and expanded the mandatory real-time invoice reporting (RTIR) system. These acts together form the legal foundation for Hungary’s digital tax compliance, mandating the use of the NAV Online Számla system and supporting the country’s transition toward broader e-invoicing adoption.

While Hungary does not yet require full e-invoicing for every transaction, it does require all invoices to be reported in real time through the Online Számla system. This applies to invoices on paper, as PDFs, or in electronic formats. The goal is to keep tax records accurate and to reduce VAT fraud. Businesses can already use several electronic formats, such as UBL 2.1, UN/CEFACT CII or PEPPOL BIS 3.0.

Whether you run a small local business or a large international company, you must report invoice data to the Hungarian tax authority at the moment the invoice is issued.

As of May 15, 2025, Hungary’s tax authority (NAV) has officially ended support for XML version 2.0. All businesses must now switch to XML schema version 3.0 when submitting invoices through the NAV Online Számla platform. This change introduces updated data fields, stricter validation rules, and improved alignment with EU e-invoicing standards. Companies still using older formats may face invoice rejections or penalties if they fail to comply. The update is part of Hungary’s broader digital strategy and prepares the country for the EU-wide ViDA (VAT in the Digital Age) rollout expected between 2026 and 2028. In addition, NAV is preparing to launch the e-nyugta (electronic receipt) system, which will eventually replace traditional cash registers for retail and B2C transactions.

Tired of scrolling through information about e-invoicing?

E-invoicing means sending and storing invoices electronically instead of using paper. This way transactions are faster, more accurate, and easier to track.

Although in Hungary it is not required to use e-invoicing for every transaction, businesses must report all invoices to the tax authority (NAV) in real time through the Online Számla system. This helps the government fight fraud and keep tax records up to date.

Hungary has a long history with fiscalization, beginning in 1999 and evolving in 2014 with the Online Cash Register System for retail and hospitality sectors. The system was further expanded in 2016 to cover the entire service sector, building the foundation for today's advanced RTIR system.

RTIR, or Real-Time Invoice Reporting, stands at the core of Hungary’s digital invoicing transformation, requiring every business to send invoice data, using the NAV Online Számla system in XML format as transactions occur.

This centralized process, in place since 2018, was designed to automate VAT reporting, greatly reduce tax fraud, and offer instant validation by NAV.

The NAV Real-Time Invoice Reporting (RTIR) system in Hungary means businesses must report invoice data to the tax authority as soon as they issue it.

Businesses connect their accounting software or back- office system to the Online Számla portal and send every invoice in a specific XML format. Our single API integration makes this process seamless, ensuring that all invoices are generated, delivered, and archived in formats compliant with Hungarian legislation.

Companies need to set up their systems with the correct tax codes, registration types, and units of measure. Each invoice is digitally signed and secured with a hash value to make sure the data is safe and accurate. Our solution automates this process, providing EU-compliant digital signatures and time-stamping for legal proof of authenticity.

For real-time reporting to be valid, invoices must include specific data elements:

To make things easier, we provide real-time monitoring dashboards that give businesses instant visibility into invoice status and compliance, reducing the risk of errors and ensuring smooth operations despite Hungary's complex e-invoicing requirements.

You do not need to know anything about e-invoicing standards or real-time reporting.

Whenever businesses issue an electronic invoice, whether to another business, government, or individual, it's sent straight to NAV's servers.

The system uses automated checks to review each invoice for errors, compliance, and signs of fraud. Invoice data must be sent in XML format, and NAV's algorithms scan for mistakes or missing details.

With our unified API integration, all transmissions occur smoothly in the background. Meanwhile, real-time validation and built-in compliance checks proactively detect issues before invoices reach NAV, significantly lowering the risk of rejections and ensuring seamless compliance.

Hungary's NAV has been steadily expanding its digital invoicing requirements since 2018. Understanding this evolution helps businesses prepare for upcoming changes:

Historical Implementation:

Future Timeline:

Discover how real-time reporting is evolving across Europe.

As of January 1, 2025, electronic invoicing has become mandatory for all commercial transactions involving electricity and natural gas. This requirement applies to all suppliers, marketers, distributors, transmission system operators, and non-consumer entities such as associations, NGOs, and societies. This sector-specific mandate represents a significant step towards broader e-invoicing adoption in Hungary.

At our company, we simplify navigation through both current requirements and future mandates with solutions that adapt seamlessly to Hungary's evolving regulations while preparing for upcoming EU standards.

B2G (Business-to-Government) Transactions

Transactions with Hungarian government bodies, municipalities, or public institutions follow standard RTIR requirements plus additional public sector mandates.

All invoices between Hungarian businesses must be reported to NAV immediately upon issuance, with no amount thresholds since April 2021. This includes cross-border EU transactions and covers all commercial activities from office supplies to consulting services.

Companies report improved efficiency in VAT return preparation and reduced discrepancies in inter-company accounting reconciliation.

Businesses issuing formal invoices to individual consumers must report transaction data to NAV while protecting consumer privacy through data anonymization.

As of May 15, 2025, Hungary requires all B2C invoices to be submitted electronically (e-Bill) to the tax authority using XML schema version 3.0 via the NAV Online Számla system. This e-Bill requirement applies to all B2C transactions where a formal invoice is issued, including professional services, online sales, digital subscriptions, and retail transactions. [email protected]

Once submitted to NAV, invoice data cannot be modified even if consumers request changes, though standard consumer protection laws continue to apply for dispute resolution.

Hungary’s tax authority (NAV) will soon require businesses to issue electronic receipts (e-nyugta), replacing traditional cash registers for retail and B2C transactions. This aligns with Hungary’s broader digital tax modernization, including RTIR and the XML 3.0 transition.

Official developer documentation and APIs for the new e-cash register system are already available on GitHub, so businesses can begin technical preparations now. Although the rollout date is not yet set, companies should review their workflows and get ready to integrate with NAV’s new requirements.

Hungarian regulations require nearly all businesses issuing invoices, including B2B, B2G, and even many B2C transactions, to use the NAV Online Számla system, submitting invoice data in real time and following strict XML format requirements.

Three specific groups are affected by these requirements:

Hungarian law requires these e-invoices to be archived securely for a minimum of 8 years, which our secure archiving system handles automatically with EU-compliant time-stamping.

Failure to comply can result in penalties up to 500,000 HUF per invoice (approximately €1,280). Even large international corporations have had to adapt their systems to ensure compliance.

Even though these rules might seem tough at first, especially keeping records for eight years, most companies find that once e-invoicing is set up, their tax reporting becomes easier, payments are tracked better, and they gain valuable business insights that paper invoices couldn't provide.

Learn how enterprises handle complex e-invoicing and fiscalization for different regulatory environments.

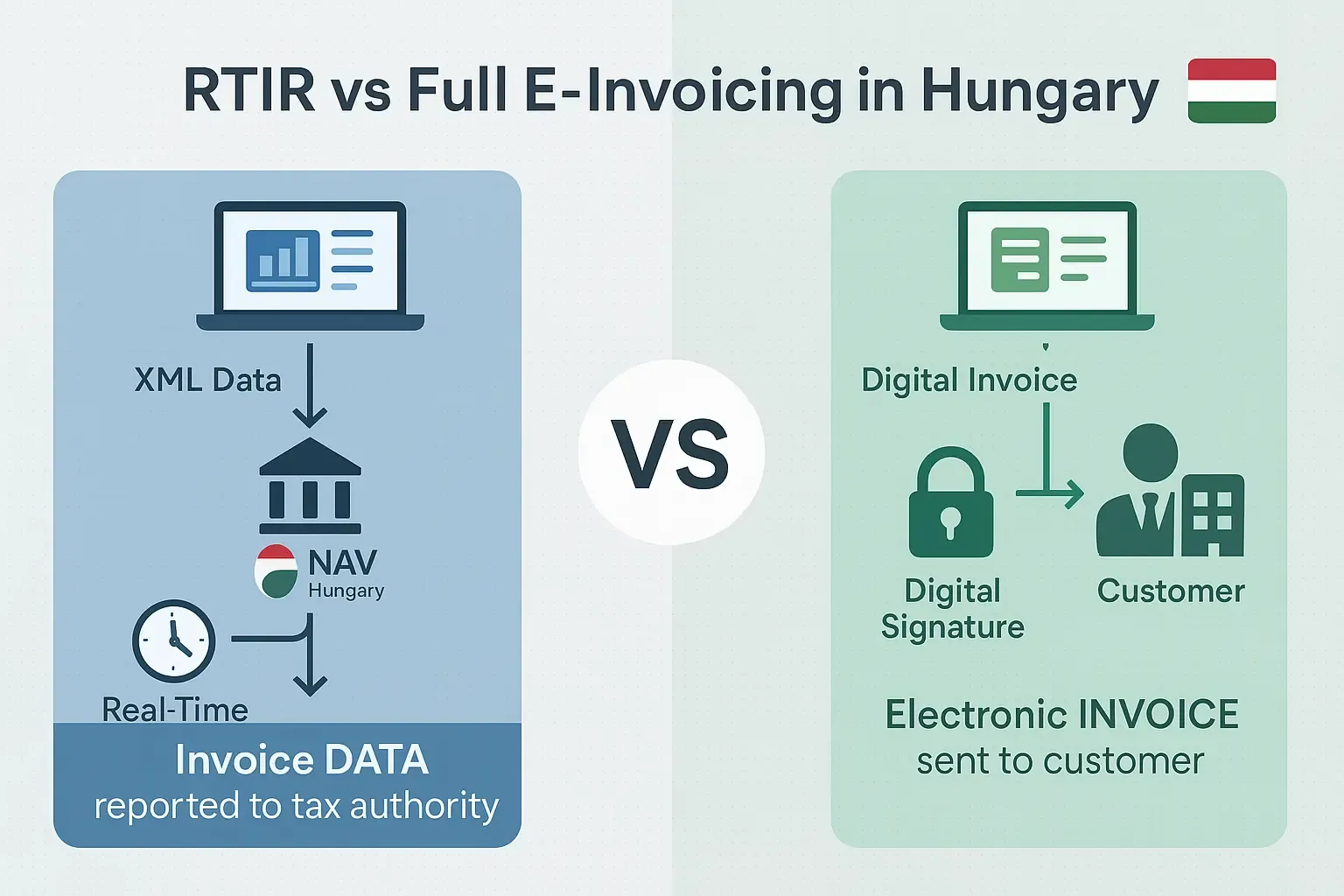

The main difference between RTIR and full e-invoicing is that RTIR (Real-Time Invoice Reporting) in Hungary means invoice data is reported to the Hungarian tax authority (NAV) in real time, but we don't distribute the invoice to the receiver in a fully electronical way.

Full e-invoicing means we send electronic invoices directly to our customers in a legally compliant electronic format directly to their software - that can happen with tax authority portal.

In countries like Serbia and Turkey, full e-invoicing is integrated with the tax authority’s portal, allowing businesses to issue, transmit, and receive electronic invoices directly within their accounting software, with the tax authority acting as an intermediary or clearinghouse.

With RTIR, every time we issue an invoice, our system sends its details usually as XML straight to NAV. This happens automatically and right away, so any mistakes get flagged quickly and we stay compliant.

Full e-invoicing takes things further. Instead of just sharing data with the tax authority, we create and send electronical invoices directly to customers. These invoices meet all legal requirements and often include digital signatures for security (pg10-11).

Full e-invoicing helps automate invoicing processes, reduces manual errors, and makes archiving easier.

SAF-T is a standardized XML format for sharing accounting and tax data with authorities during audits. Hungary has been preparing to introduce SAF-T (Standard Audit File for Tax) as part of its digital tax modernization efforts. While not yet mandatory in Hungary, businesses must be able to generate SAF-T reports when requested by NAV.

Your Trusted Partner for E-invoicing in Hungary

To get ready for full e-invoicing, we start by reviewing how we currently handle invoices. We map every step, from creating invoices in our ERP system to reporting them in NAV’s Online Számla platform.

If you work with us, our single API solution simplifies this transition by automatically converting invoices to the required XML format, adding digital signatures, and transmitting them to the tax authority.

We also prioritize security, compliance, and efficiency through automated validation, while our secure archiving system stores e-invoices for the required 8+ years with EU-compliant time-stamping.

Ready to transform your Hungarian invoicing process? Get started with DDD Invoices today and focus on growing your business while we ensure your compliance.

Still have questions?

In the 30min free call we will discuss:

Yes, real-time invoice reporting is mandatory. While Hungary does not yet require full e-invoicing for every transaction, all businesses, Hungarian or foreign operating locally, must report invoice data in real time via the NAV Online Számla system, regardless of whether the invoice is issued in paper, PDF, or XML format.

RTIR (Real-Time Invoice Reporting) means sending invoice data to NAV in real time. It’s a legal obligation in Hungary. Full e-invoicing, on the other hand, involves issuing structured digital invoices directly to customers, often using XML or signed PDF formats. RTIR is about tax authority compliance; full e-invoicing focuses on digital transaction flow between businesses.

Invoices must be submitted in XML format through the Online Számla system. As of May 15, 2025, only XML version 3.0 is accepted. Businesses must include key invoice metadata (e.g., issuance time, software version, invoice type) and use secure digital signatures and hash values. Integration with NAV’s API is essential.

Written by the Compliance team

Reviewed by Denis V. P.