All About B2B E-Invoicing in Germany

Germany’s Wachstum-schainz-konzept Mandates phased B2G, B2B, and B2C E-Invoicing by 2028, Aligned with EU EN 16931 Standard and ViDA Directive for Digital Tax Compliance

-1.webp&w=3840&q=75)

-1.webp&w=3840&q=75)

Last modified on 2025-12-29 in Blog

xRechnung, ZUGFerD

ZRE, OZG-RE

Bundesministerium der Finanzen

To be announced

2020 - phased

1.1.2027

10 years

Germany is actively preparing for its B2B e-invoicing initiative as part of the Wachstumschancengesetz (Growth Opportunities Act), a law aimed at promoting business growth, simplifying taxes, and ensuring tax fairness. Germany has positioned itself as a digital transformation leader by implementing one of Europe's most comprehensive B2B e-invoicing mandates.

Starting January 1, 2025, all German businesses must be capable of receiving structured electronic invoices based on the EN 16931 standard, with mandatory sending requirements phased in from 2027 for companies with annual turnover exceeding €800,000, and universal sending requirements by 2028. This progressive approach allows businesses time to adapt while establishing Germany as a pioneer in VAT compliance digitalization. By mandating structured, secure e-invoicing through standardized formats like XRechnung and ZUGFeRD.

In June 2023, the European Commission recommended to the Council that Germany should proceed with its B2B e-invoicing mandate, with Germany receiving a temporary exemption starting from January 1, 2025, until December 31, 2027, or until the adoption of ViDA.

Germany has rescheduled the proposed e-invoicing deadline for issued e-invoices to January 2027. This is due to the Bundesministerium der Finanzen (BMF) revised proposal of the Growth Opportunities Act following a public consultation in May 2023.

Key updates include the confirmation of XRechnung and ZUGFeRD as approved formats, revised compliance timelines, and enhanced integration requirements for businesses across all sectors.

Tired of scrolling through information about e-invoicing?

E-invoicing is the process of generating, transmitting, and storing invoices in a structured digital format. In Germany, the XRechnung is based on an XML data format, consisting of a data set in the form of lines of code rather than a readable document, while ZUGFeRD is a hybrid invoice format that combines a PDF version with embedded XML data, giving businesses a flexible solution that supports both traditional PDF-based workflows and automated digital processes.

Germany's e-invoicing relies on decentralized systems allowing businesses to choose compliant e-invoicing solutions while maintaining strict format standards. These solutions help reduce errors, speed payments, and ensure invoices meet regulatory requirements. This system supports Germany's move toward full digital tax compliance, processing structured B2B transaction data through approved formats and platforms.

Want to see how Germany's e-invoicing evolution compares with other EU countries? Explore our complete guide to e-invoicing in Europe.

Germany is making e-invoicing mandatory to simplify billing and improve tax compliance starting in 2025. The transition covers both government (B2G) and business (B2B) transactions, with key deadlines set between 2020 and 2028.

18 April 2020 - Contractors and government suppliers must be able to receive and process e-invoices

27 November 2020 - Mandatory issuance of e-invoices at the federal level in the state of Bremen

1 January 2022 - Mandatory in the states of Saarland, Hamburg and Baden Württemberg

1 April 2023 - Mandatory in the state of Mecklenburg-Western Pomerania

1 January 2024 - Mandatory in the state of Rhineland-Palatinate

18 April 2024 - Mandatory in the state of Hessen

2025: B2G sector e-invoicing obligation has largely been implemented in Germany

1 January 2025: All companies must be able to receive electronic invoices starting from January 2025 (B2B transactions)

1 January 2027: German taxpayers with an annual turnover of at least EUR 800,000 must issue e-invoices for B2B transactions

1 January 2028: Remaining German taxpayers must issue e-invoices for B2B transactions

.webp&w=1920&q=75)

In Germany, all public administrations must handle electronic invoices through standardized formats, primarily XRechnung, which complies with the EN 16931 European standard.

The European Directive 2014/55/EU mandates that all public administrations within EU Member States must be able to receive and process electronic invoices that comply with the European standard defined by the European Committee for Standardization.

Germany implemented this directive comprehensively, establishing XRechnung as the primary format for public sector invoicing. ZRE ( Zentrale Rechnungseingangsplattform) will no longer be available as of 2025, streamlining the process to focus on standardized formats.

Mandatory Use of XRechnung: All invoices issued to public administrations must use the XRechnung format, ensuring standardized processing and validation

Invoice Format: Invoices must comply with EN 16931 European standard, including specific fields required by public procurement regulations

Additional Mandatory Data: B2G invoices must include unique identifiers such as the Leitweg-ID for proper routing to the correct public entity

Digital Compliance: Invoices must meet technical specifications for automated processing and validation

Invoice Rejection: Invoices not complying with XRechnung format specifications are rejected and will not be processed for payment

All German companies must be prepared to receive electronic invoices based on EN 16931 standard as of Jan 1st 2025, with sending remaining optional until 2027 for companies with annual turnover €800,000, and mandatory for all from 2028.

The German approach emphasizes flexibility by allowing businesses to choose between approved formats while maintaining strict compliance standards.

Input tax deduction is permitted only for compliant invoices for transactions subject to mandatory e-invoicing, this means an e-invoice that fully meets the requirements of the German VAT Act (Articles 14 and 14a UStG)

The adoption of B2C e-invoicing in Germany is accelerating as more consumers turn to digital solutions for managing their financial transactions. This approach allows businesses to deliver invoices directly to consumers’ electronic devices, such as smartphones, tablets, or computers.

By providing instant access to invoices, B2C e-invoicing streamlines the payment process and enhances convenience for consumers. It empowers them to easily view, organize, and settle their invoices digitally, improving overall efficiency and user experience.

In contrast to some countries with mandatory fiscalization systems, Germany currently does not require real-time fiscal reporting or certified electronic cash registers for B2C sales.

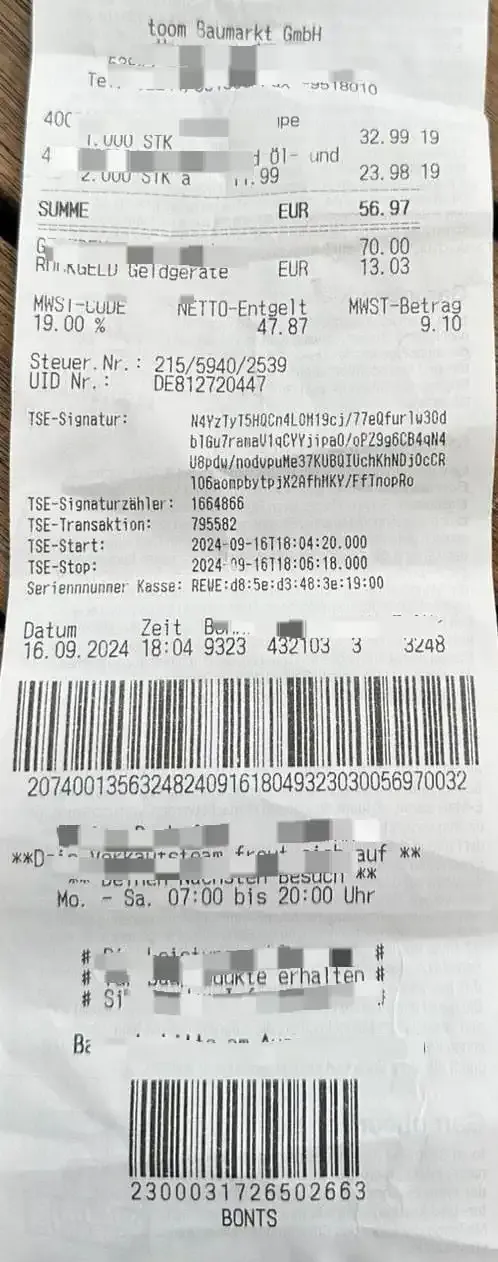

B2C transactions have the strictest fiscalization requirements:

Real-time transaction-level fiscalization is mandatory using a certified Technical Security System (TSE).

The TSE is a tamper-proof hardware/software module that records each individual transaction and generates a digital signature.

This digital signature must be printed on the customer receipt as a QR code or other machine-readable format.

Each cash register or POS system requires its own certified TSE device.

Non-compliance with B2C fiscalization requirements can lead to significant penalties, including fines and potential criminal charges.

To ensure compliance with fiscalization requirements at each physical location, companies can leverage our POS invoicing and fiscalization API, providing certified, tamper-proof transaction recording and reporting.

The main approved e-invoice formats include XRechnung and ZUGFeRD, which support efficient, standardized, and legally compliant digital invoicing.

Based on XML (Extensible Markup Language), it contains all the necessary invoice information in a machine-readable format, enabling automated processing and validation.

The XRechnung format is used for B2G e-invoicing which can be used for the Peppol network as well as many other aforementioned platforms similar to Belgium and France. This format is required for sending e-invoices to the German government administration and is a pure data record.

An essential element of the xRechnung format is the Letiweg ID or routing ID. This is composed of elements such as a state code (Kennzahl des Regierungsbezirks), fine addressing (Feinadressierung), and a check digit (Prüfziffer). An additional benefit to this format is that it can be also used to transmit invoices through the European Peppol network.

.webp&w=1920&q=75)

ZUGFeRD is a hybrid electronic invoice format that embeds structured XML invoice data within a PDF/A-3 document, allowing both human readability and automated processing.

Since version 2.1, ZUGFeRD has been fully compatible and technically identical with the French Factur-X standard, enabling seamless cross-border invoicing between Germany and France.

Both ZUGFeRD and Factur-X comply with the European standard EN 16931, ensuring interoperability and legal compliance within the EU electronic invoicing framework.

When it comes to issuing electronic invoices across borders within the EU, the approach is flexible and largely depends on the agreement between the involved parties. Foreign companies issuing invoices to German businesses are encouraged to align their e-invoices with the EN 16931 standard, especially as mandates become fully effective.

From January 2025, German businesses will be required to process e-invoices in compliant structured formats. To facilitate seamless cross-border transactions within the European Digital Single Market, interoperability is emphasized through widely adopted formats such as PEPPOL BIS.

This ensures that companies can choose and agree upon the most suitable invoicing formats and transmission channels that work best for their specific cross-border business relationships.

Germany's e-invoicing system operates on a decentralized model, contrasting with centralized platforms used in countries like Italy and Serbia.

How the System Works:

Decentralized Architecture: Businesses select their own compliant e-invoicing providers and platforms

Format Standardization: All solutions must support EN 16931 compliant formats (XRechnung, ZUGFeRD)

Direct Exchange: Invoices can be transmitted directly between trading partners using approved formats

Third-Party Platforms: Businesses can use certified service providers for format conversion and transmission

The system does not require routing through a single government platform, allowing businesses to maintain their preferred workflows while ensuring compliance. Service providers must offer secure transmission, proper archiving, and format validation to meet regulatory requirements.

For enterprises seeking advanced, scalable e-invoicing and fiscalization solutions, our enterprise invoicing platform delivers comprehensive compliance and integration features.

Germany's approach to e-reporting emphasizes real-time compliance through structured e-invoicing rather than periodic reporting mechanisms. Unlike some EU countries that rely on SAF-T (Standard Audit File for Tax) formats, Germany focuses on continuous transaction monitoring through mandatory e-invoice data.

The structured data from compliant e-invoices provides tax authorities with real-time visibility into B2B transactions, supporting enhanced VAT compliance monitoring and fraud prevention. This approach aligns with the broader EU trend toward continuous transaction controls and real-time reporting.

With evolving regulations and technical requirements, partnering with a certified e-invoicing provider ensures your business stays compliant and efficient.

DDD Invoices simplifies the process. We support both XRechnung and ZUGFeRD formats, provide seamless integration with your existing systems, and ensure secure, compliant invoice processing. This allows you to focus on your core business while we handle the technical complexities.

Our platform lets you offload the technical complexities of mandatory e-invoicing transitions, helping you embrace digital transformation efficiently and securely.

Still have questions?

In the 30min free call we will discuss:

From January 2025, all German companies must be able to receive and process electronic invoices. From January 2027, German companies with an annual turnover of more than €800,000 must issue their invoices electronically. From January 2028, all German companies must issue their invoices electronically.

Germany accepts XRechnung and ZUGFeRD formats, both complying with the EN 16931 European standard. XRechnung is pure XML format ideal for automated processing, while ZUGFeRD is a hybrid format combining PDF and XML data for flexibility.

Germany uses a decentralized approach, allowing businesses to choose their own compliant solutions, unlike countries such as Italy that use centralized government platforms. This provides more flexibility while maintaining strict format compliance requirements.

Written by the Compliance & Growth Team

Reviewed by Denis V. P.