DDD Invoices Stripe plugin allows businesses to comply e-invoicing & fiscalization requirements when invoicing or receiving payments with Stripe.

The Stripe plugin is available for install here.

Introduction video:

Technically the plugin functions by receiving a invoice trigger (usually after successful payment notification; meaning that the invoice status must be "paid" in Stripe) from the Stripe with the transaction data, then creates a local e-invoice XML (and delivers it to the local tax portal) or it fiscalizes the transaction and can also generate a PDF with a QR code and delivers it to the receiver of the invoice via email.

We are currently onboarding businesses from Slovenia, Croatia, Romania, Italy, Montenegro, Serbia, Germany, all countries for PEPPOL e-invoicing etc. and soon also Greece, Hungary and other nations!

Step-by-step guide overview

What you need before you start:

- 30 minutes of your time

- certificate/API key for e-invoices/fiscalization in order to do authentication with the tax authority (this depends of your country requirements; see delivery channels under Step 3 for more info)

- Stripe account set-up and operatable (in the live environment)

Overview of the steps needed to make your Stripe transactions compliant:

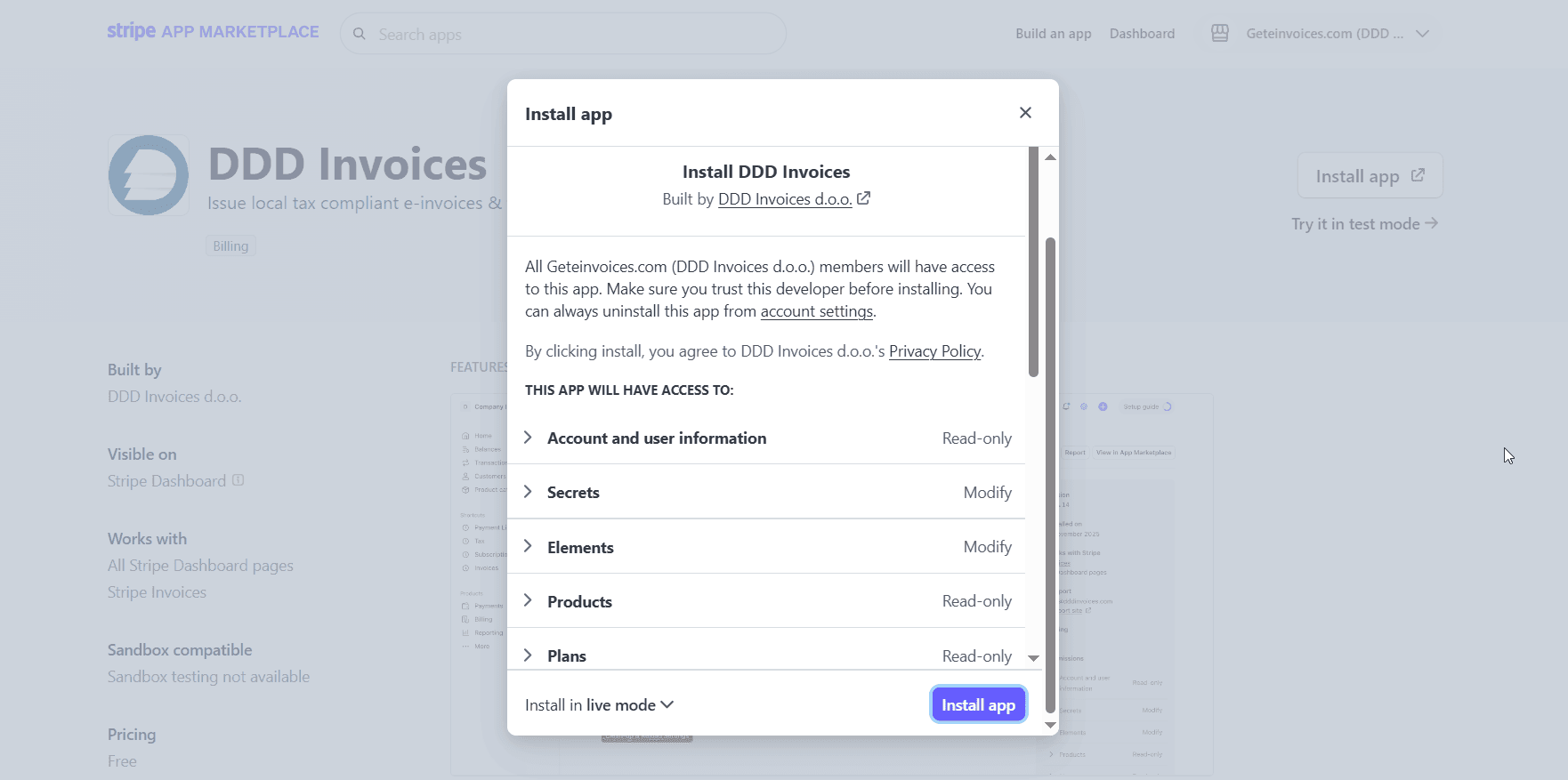

1. Install the Plugin to configure the workflow in Stripe

2. Verify Your Tax Settings in Stripe

3. Set-up company & delivery channels in DDD Dashboard

4. Choose a payment package & switch to production!

Full step-by-step video guide for set-up:

1. Install the Plugin to configure the workflow in Stripe

Click this link to install the DDD Invoices plugin (you need a Stripe account): https://marketplace.stripe.com/apps/ddd-invoices

Open Stripe and click on the DDD Invoices plugin

Insert you email and tax number and click Sign-In:

Open Settings of the DDD plugin inside Stripe.

Turn ON “Auto-processing of invoices” so every invoice/transaction/subscription is automatically sent to DDD Invoices.

And set up the workflow that you need for your use-case and country.

Here is a country & use-case guide for steps workflows, that will tell you which combination of steps you need for your use-case.

Click SAVE (and watch for black confirmation box on the bottom)!

2. Verify Your Tax Settings in Stripe

Ensure Tax Registration in Stripe is input in Stripe (if you are registered for VAT; if you are not or are an exempt, you will find below under section "Custom VAT rates" how to insert a specific exemption into Stripe to have them appear on invoices.).

This will allow you to enable Stripe Tax, to collect taxes automatically.

Example:

Write Settings → Tax in the Stripe toolbar:

Decide whether:

- for B2B typically: taxes are excluded from item price.

- for B2C typically: taxes are included in item price

Verify that your products/subscriptions have automated tax rates enabled, or insert taxes manually.

If you send invoice with rate 0% VAT from Stripe, we will put on the invoice the most general VAT exemption code available. As e-invoices require specific code for the VAT, you cannot simply insert a 0% VAT without a specifed reason for exemption. For this reason, follow the Custom VAT rates guide bellow to specify what exemption code (and consequentally also exemption clause) you want on your invoices.

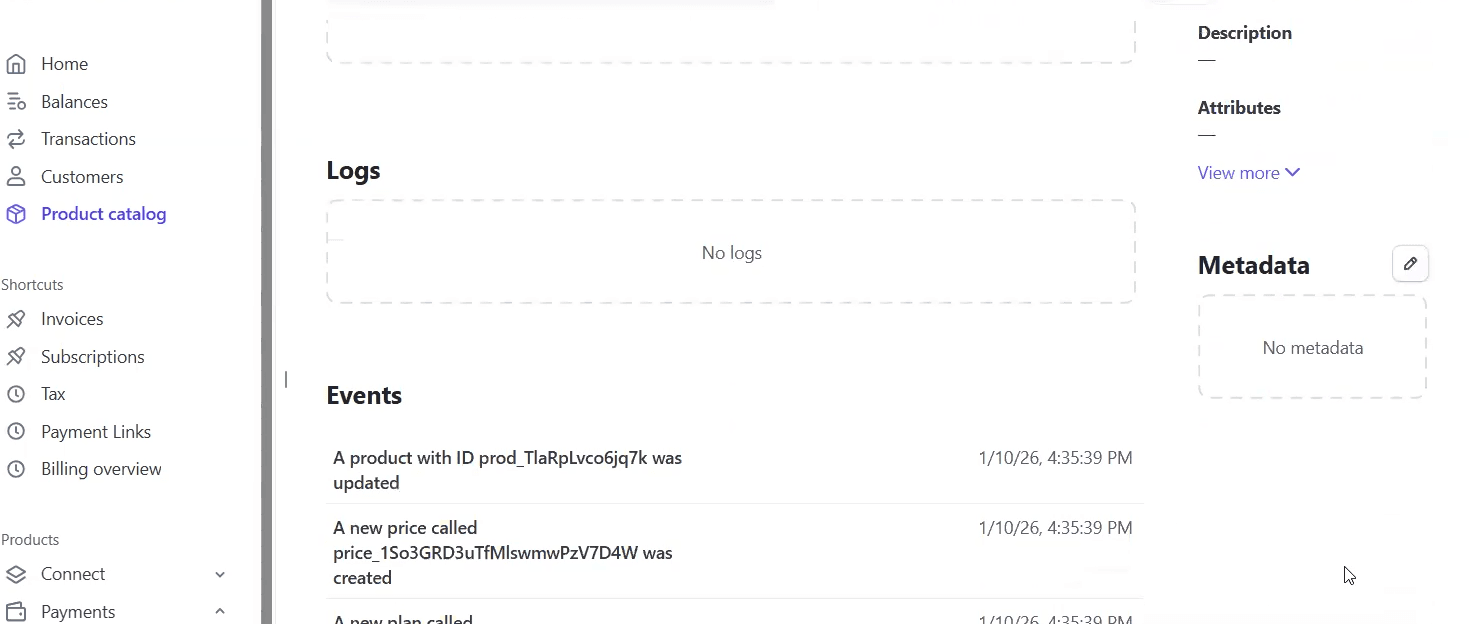

Custom VAT rates

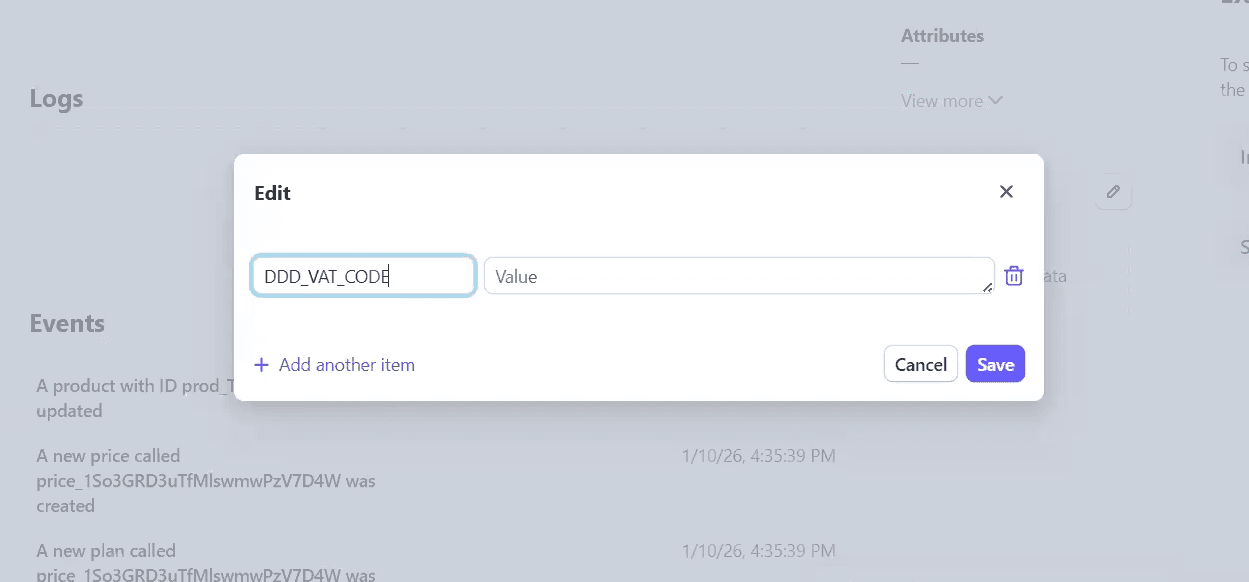

Here we can set-up the meta-data for the product if you are for example VAT exempt, or have transactions who require exemption handling, and want to have have extra VAT rates/clauses/codes not provided by Stripe. Here is a video about that.

Example of meta data in Stripe:

Click on specific product -> Meta data on the right side (image below) -> Insert in the field key "DDD_VAT_CODE" and insert in the field value correct code found in on this link (second image below). Here is a video to help you with that.

3. Set-up company & delivery channels in DDD Dashboard

Click “Go to Dashboard” at the bottom of the DDD plugin in Stripe.

In the DDD Invoices dashboard → click the person icon (top-right corner).

Fill in all Company Details (most of this data is required to be visible on the invoice) and click SAVE!

In the DDD Dashboard on the left side, go to Settings → Delivery Channels.

Depending on the use-case and country you might need to set-up different Delivery Channels and insert authentication credentials (certificates, API keys etc.)

Click here for the guides for delivery channel set-up per country & use-case which will tell you how to obtain the authentication credentials.

Optional step - test sending into the test environment of the tax authority

You don't need to, but you can test sending invoices from Stripe to the test tax authority portal and you’ll be using DDD’s test authentication with the tax portal.

Go to Invoices Tab and try sending an invoice, subscription, payment link with a small amount!

Click on one invoice to view the status of that specific invoice! In order for the invoice to get sent to our service the invoice in Stripe should have the status "paid".

A successful test means that all Steps selected in the plugin Settings page were executed.

By going to the DDD Invoices dashboard on the LEFT sidebar menu is Invoice Flow Control → Issued Invoices you can see your whole invoice flow of all your invoices.

4. Choose a payment package & switch to production!

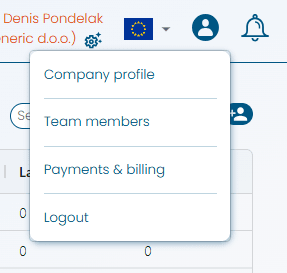

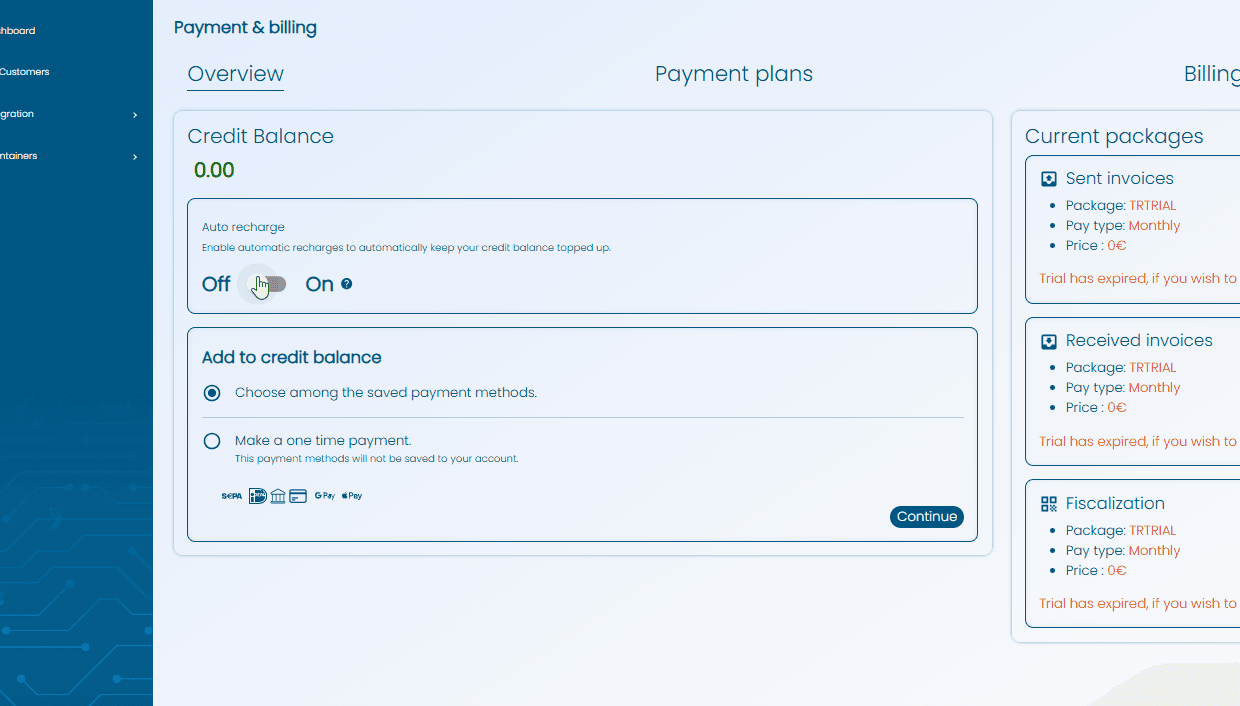

In the right corner menu click on the "person" icon and click on Payments & Billing

A payments and billing section will open, where you can see your uploaded credit amount, payment plans invoices and more.

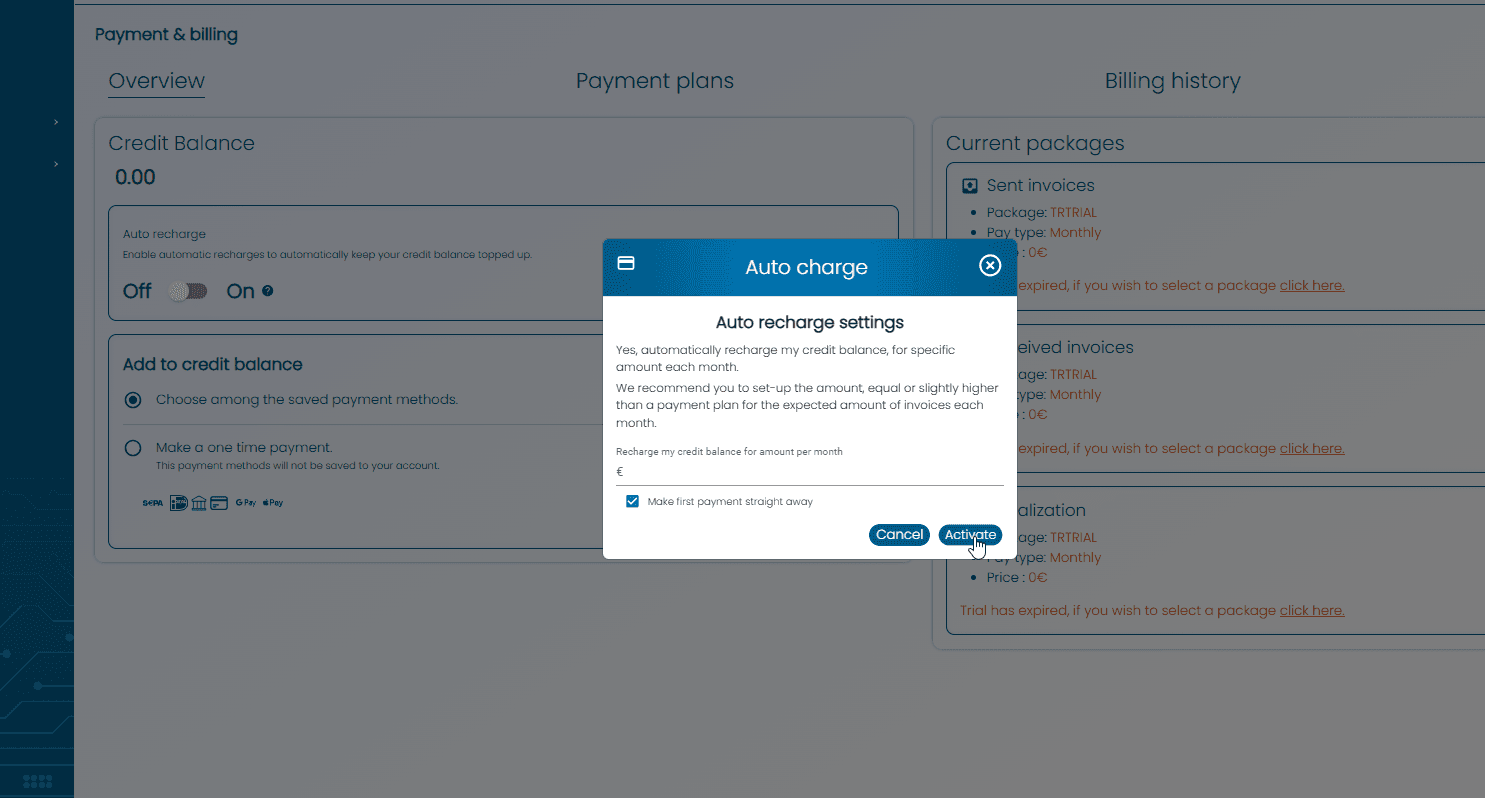

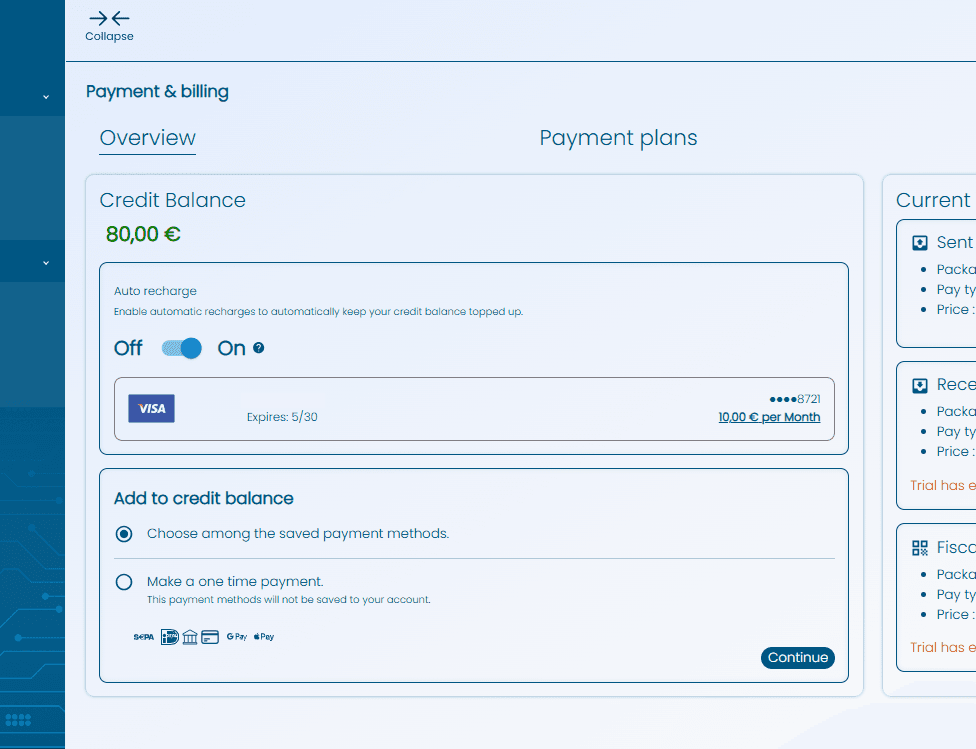

Click on the Auto-recharge option to always keep you account topped up and enter the amount that is the same or slightly higher then the package price, to account for invoices going over the limit.

Complete the purchase and the card together with the payment plan should be saved in the dashboard.

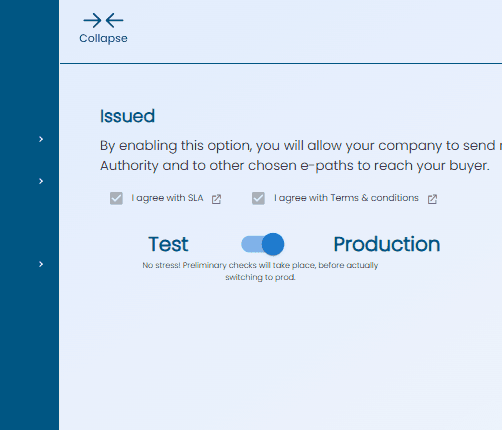

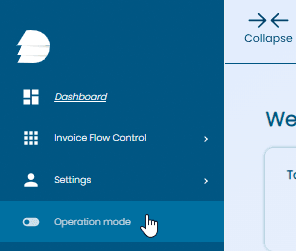

In the DDD Dashboard and go to Operation Mode.

Turn Issued Invoices from Test → Production. (No stress, preliminary check will take place, but do this only when you are ready to start issuing invoices to the tax portal!)

The toggle should switch to the production and that's it! You are done!

Congratulations!

You can now start generating and distributing tax compliant documents via DDD Invoices from your Stripe transactions!

Once you collect a few, they should look like this in the DDD Invoices dashboard. Happy invoicing!

What clients say

FAQ

- What is Stripe?

Stripe allows businesses to accept online payments from customers - via credit cards, debit cards, digital wallets (like Apple Pay or Google Pay), and even bank transfers - all through a secure API or integration.

- What does the DDD Invoices Stripe plugin do?

The plugin connects your DDD Invoices account with Stripe, allowing you to automatically sync invoices, payments, and customer data between both platforms. It streamlines billing and reduces manual data entry.

- Do I have to install plugin for multiple Stripe accounts or legal entities?

One legal entity equals to one DDD Invoices plugin instalation (because you are registering legal entity on DDD Invoices). You can use the same DDD Invoices account with multiple Stripe accounts, provided there is the same legal entity in the background.

- How do I connect my Stripe account to DDD Invoices?

The Stripe plugin is available for install here.

- Does the plugin automatically record and processes Stripe payments?

Yes, turn auto-processing on in Settings inside Stripe dashboard. in DDD Invoices plugin.

- Can I use this plugin with all Stripe events (invoicing, payment link, checkout, subscriptions etc.)?

It works on all, that will trigger the "invoice" event. For most this is done automatically, however for invoice after one time payment your can do this via Checkout Session API or via Payment Link and for this your for turn on "Post-Payment Invoice" (in each payment link).

- How do I issue refunds?

Refund the payment/transaction via Stripe first and then via plugin in right passage inside the Stripe, manually storno/void the transactions/invoice to the tax authority. (Note: you need to have activated at least Step 45.)

- What currencies are supported?

The plugin supports all currencies available in your Stripe account. When creating invoices in DDD Invoices, make sure to select a matching currency to ensure proper synchronization.

- Is customer information shared between DDD Invoices and Stripe?

Yes, customer data such as name, email, and payment details are synced securely between platforms to ensure accurate billing records.

- How do I disconnect DDD Invoices plugin from Stripe?

You can disconnect your DDD Invoices account anytime by uninstalling it from Stripe. Once disconnected, syncing will stop, but your past records will remain intact in DDD Invoices. Contact us for deletion of the data.

- Is the DDD Invoices Stripe plugin secure?

Absolutely. The plugin uses Stripe’s OAuth and API security standards to ensure all data is transmitted and stored securely. DDD Invoices does not store sensitive payment information directly.

- Will the customer receive the invoice with QR code/e-invoice by itself?

Yes, if you also choose Step 86 (send via email) in the workflow. You can then also turn off Stripe invoices that are send to your clients, so client does not receive two invoices.

- Do you also send invoice via email to the end-client?

Yes, if you choose to Step 86!

- How to add additional emails on which I want my invoices to be sent to? (e.g. to accountant)

to help you with that.

- Can I also set other units or tax rates than what Stripe offers?

Yes, you should include them under the meta-data of the product in the Stripe dashboard.

Here is a video about that.

Insert "DDD_UMC_CODE" and insert a unit from the list here:

Value set:

year (leto)

kW (kW)

kWh (kWh)

day (d)

kg (kg)

min (min)

t (t)

piece (kom)

g (g)

hour (h)

km (km)

l (l)

m (m)

month (M)

m2 (m2)

m3 (m3)

NN (NN)

Item: Unit of measure code (standard units described in appendix)

Same for custom tax rates:

Click on specific product -> Meta data on the right side -> Insert in the field key "DDD_VAT_CODE" and insert in the field value correct code found in on this link (second image below). Here is a video to help you with that.

- How does enumeration of invoices works?

Your Stripe invoice number will be the same as the invoice number in DDD Invoices.

For settting up the enumeration towards the government, you need to go into DDD Invoices dashboard under Delivery Channels and set-up and potential fiscalization/e-invoice enumeration towards government there.

- Can I export my invoices from the system?

Yes, we offer comprehensive exporting options. See this video for more info.

- Do you offer refunds?

All payments are final and non-refundable. Because DDD Invoices generates fiscally binding documents and triggers external compliance processes in real time, we can’t recerse usage once it happens.

- Have additional locally specific tax related questions?

Try to find the answer among these Q&A.

- Need help with setting up your Stripe settings or need support?

Book a session via this link here (and please tell specifically in which step you are experiencing a roadblock).

.webp&w=3840&q=75)

.png&w=1920&q=75)

.png&w=3840&q=75)

.png&w=1920&q=75)

.png&w=1920&q=75)

.png&w=1920&q=75)

.png&w=1920&q=75)

.png&w=1200&q=75)

.png&w=640&q=75)

.png&w=1920&q=75)

-1.png&w=1920&q=75)

.png&w=1920&q=75)

.png&w=1920&q=75)

-1.png&w=1920&q=75)

-1.png&w=1920&q=75)

-1.png&w=1920&q=75)

-1.png&w=1920&q=75)

.png&w=1920&q=75)

-1.png&w=1920&q=75)

-1.png&w=1920&q=75)