E-invoicing in Portugal (2025 Updates)

Portugal requires CIUS-PT e-invoicing only for B2G suppliers, while B2B e-invoicing is not yet mandatory. All invoices must include QR and ATCUD codes to enhance transparency and reduce tax fraud.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

Last modified on 2025-12-19 in Blog

UBL 2.1 "CIUS-PT", CEFACT "CIUS-PT"

eSPap / FE-AP

Autoridade Tributária e Aduaneira (AT)

Post-audit

2021

n/a

10 years

Many European countries like Finland, Germany, and Belgium, have already expanded the use of e-invoicing to make tax systems more efficient. At the moment, mandatory e-invoicing applies only to suppliers invoicing public entities (B2G), while B2B e-invoicing is still optional. However, all businesses must add a QR code and an ATCUD unique code to their invoices, which helps increase transparency and support tax control.

The Portuguese government is gradually moving towards e-invoicing to make business transactions more secure, transparent, and efficient. For now, e-invoicing is mandatory only for transactions with public administrations, and there is currently no confirmed date for extending this to B2B transactions.

Portugal hasn’t made pure XML. e-invoicing a big deal for everyone just yet. While there are strict rules in place for real-time reporting, most businesses can still choose how they want to handle their invoices.

Portugal is continuing its digital transformation with steady updates to its e-invoicing system. One of the key changes is the plan to require a Qualified Electronic Signature (QES) on PDF invoices starting January 1, 2026. This step is meant to make digital invoices more secure, more reliable, and easier for businesses and authorities to trust.

Invoices must also include a QR code and an ATCUD unique code, which help improve traceability and support better tax control. Together, these updates show Portugal’s commitment to modernising its invoicing process and keeping pace with the EU’s wider move toward digitalisation.

You do not need to know anything about e-invoicing standards or real-time reporting.

E-invoicing in Portugal refers to the process of issuing and receiving invoices in a structured electronic format, which aligns with the European eInvoicing standard EN 16931. This format ensures that invoices are machine-readable and can be processed automatically, reducing errors and improving efficiency. The Ministry of Finance is responsible for e-invoicing initiatives, and the Public Procurement Code has been updated to comply with EU Directive 2014/55/EU, mandating electronic invoicing for public contracts.

Portugal's adoption of e-invoicing aims to modernise the tax system, enhance transparency in business transactions, and combat tax fraud. By implementing structured invoice submissions, businesses can streamline operations such as VAT reporting, accounting summaries, and audit preparations. This initiative is in line with the EU's strategy for digital reporting under Directive 2014/55/EU.

Portugal is shifting from traditional paper invoices to electronic ones as part of its effort to modernize tax reporting and strengthen control over business transactions. While structured formats like CIUS-PT are required for invoices sent to public administrations, all businesses must include tools such as the ATCUD code and QR code on their invoices.

This change is improving transparency, reducing tax fraud, and aligning Portugal with EU digital reporting requirements. It also reduces paperwork for businesses and makes tasks like VAT submissions and audits easier to manage. Certified e-invoicing solutions are being promoted to support companies of all sizes in adapting to these new rules.

Portugal, just like the rest of the EU, had to follow Directive 2014/55/EU and make e-invoicing mandatory in public procurement. To do this, the government introduced its own national standard called CIUS-PT. All invoices sent to public authorities now have to be issued in this structured format, moving through certified platforms and the eSPap system (the public administration’s shared services body).

This started back in 2021 with larger companies and over time, smaller suppliers were included as well. By 2023, structured CIUS-PT e-invoicing will become compulsory for all suppliers, including SMEs and microenterprises, when working with the public sector.

All public procurement invoices must use the CIUS-PT format and be sent through certified providers or the eSPap portal. This phased system makes invoicing with public agencies clearer and more transparent, helps track public spending, and keeps Portugal aligned with EU digitalisation goals.

.webp&w=1920&q=75)

Portugal has not made structured e-invoicing mandatory for B2B transactions, but businesses still have to follow several digital invoicing rules set by the tax authority. These rules aim to make invoicing safer, more transparent, and easier to track.

All B2B invoices must be created using certified invoicing software approved by the tax authority. They also need to include a QR code and the ATCUD unique code, introduced under Decreto-Lei n.º 28/2019 and Portaria n.º 195/2020. These elements help verify invoice details and connect them to the tax system.

Businesses must also report their invoice information either through SAF-T (PT) files. This keeps records accurate, supports tax control, and helps companies stay compliant with Portugal’s digital reporting requirements.

In Portugal, B2C sales do not require structured e-invoices like B2G or some B2B transactions. However, all sales must be reported electronically to the tax authorities, ensuring that VAT and other transaction details are properly recorded.

Businesses can still issue paper or PDF receipts to consumers, but the underlying transaction data must be submitted in real time or close to real time through certified invoicing software. Retailers such as supermarkets, restaurants, cafes, and other consumer-facing businesses are required to use fiscalized cash registers or certified POS systems.

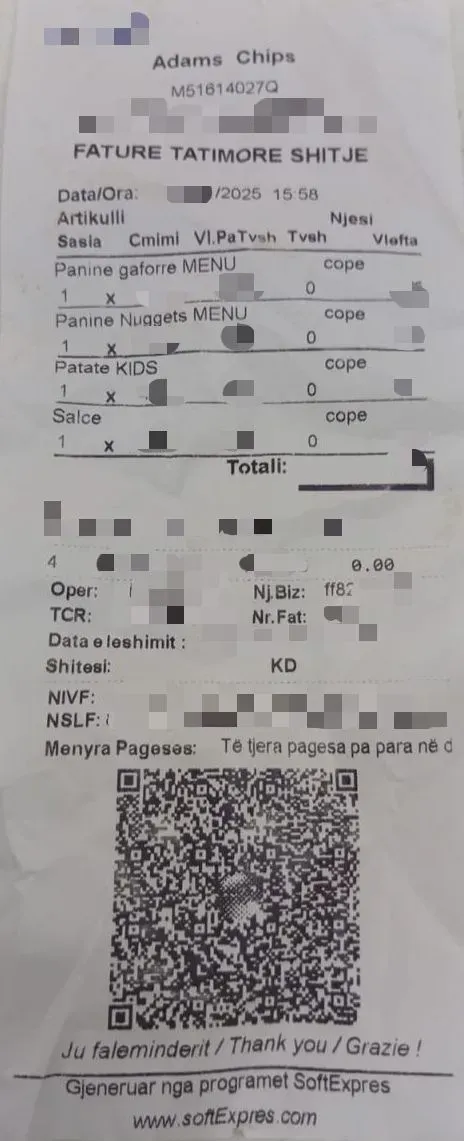

In Portugal, fiscalization is a main part in the retail business. Certified POS systems or fiscal cash registers must issue receipts with all required elements, including a QR code and the ATCUD unique identifier, and automatically report transactions to the tax authority.

Payments made by card or cash are matched to receipts in real time, ensuring every sale is accurately recorded. These devices must be certified by the Portuguese Tax Authority (AT) and installed by authorized technicians.

Foreign companies registered for Portuguese VAT must issue invoices using certified invoicing software approved by the Autoridade Tributária e Aduaneira (AT). Each invoice needs to include the required elements set out in Article 36 of the Portuguese VAT Code, along with a unique ATCUD code and a QR code. These rules ensure that all invoices are traceable and compliant with national VAT standards.

If a foreign supplier doesn’t have a Portuguese VAT number, they usually don’t need to issue Portuguese VAT invoices. However, when the Portuguese customer is under the reverse-charge mechanism, they must account for the VAT and keep proper records. Invoices to public authorities must follow the CIUS-PT e-invoicing format and be sent through the FE-AP platform, as non-compliant or late invoices can lead to penalties.

Portuguese businesses must comply with electronic invoicing, reporting, and fiscalization requirements as defined by the Autoridade Tributária (AT). Failure to issue invoices correctly, use certified invoicing software, or report transactions in real time can lead to financial penalties.

For example, companies that do not issue or transmit invoices properly may face fines ranging from €150 up to €10,000 per offense, depending on the size of the business. Retailers failing to use certified fiscal devices or POS systems can be fined up to 50% of the VAT involved, with minimum amounts applied based on company classification. Repeated or serious offenses can result in doubled fines, and in extreme cases, temporary suspension of business operations.

As Portugal gradually expands its e-invoicing requirements, businesses need to ensure their invoicing system complies with the rules set by the Autoridade Tributária (AT). Choosing the right e-invoicing provider can help companies stay compliant, streamline operations, and avoid errors.

It’s important to select a provider that is certified by the AT and fully supports the Portuguese CIUS-PT standard and EN 16931 format. The provider should also keep systems updated with any regulatory changes so your business remains compliant.

At DDD Invoices, we offer fully compliant, seamless, and up-to-date e-invoicing solutions for Portuguese businesses. Our services are designed to help companies meet all B2G requirements efficiently, prepare for upcoming B2B obligations, and ensure accurate reporting without added stress.

Still have questions?

In the 30min free call we will discuss:

Businesses that fail to issue or transmit invoices correctly, or don’t use certified invoicing systems, can face fines ranging from €150 to €10,000 per offense. Retailers not using certified fiscal devices can be fined up to 50% of the VAT involved, with minimum fines based on company size. Repeated offenses may lead to higher penalties or even temporary suspension of business activities.

Businesses should use certified invoicing software that supports CIUS-PT and EN 16931, including fiscalized POS devices for retail. Systems must report transactions in real time or near real time to the tax authority.

Using a certified provider ensures your invoices are compliant with Portuguese law, reduces the risk of errors or penalties, streamlines reporting, and simplifies audits and VAT reconciliation.

Written by the Compliance team

Reviewed by Denis V. P.